The famous author Ralph Waldo Emerson once said, “The only person you are destined to become is the person you decide to be.” While I fully embrace this statement, it requires an addendum. To become that person, you first need to know yourself, your identity, the behaviors that are your essence, and how you deal with money.

Having spent many years exploring financial well-being from every angle to help others, the most valuable insight I can share is that it is contingent on one’s relationship with money—regardless of how well you know yourself. It’s part of the journey to self-awareness.

Beyond the Rainy Day Fund: Crafting a Financially Secure Future and Stress-Free Present

Most of us have heard the saying and the need for a “rainy day fund.” That’s when you build up a money reserve to help supplement those times when your regular income is insufficient to cover irregular expenses and maintain financial stability. While this is a compelling objective and a healthy consideration when establishing an emergency fund and financial planning, we must address how your relationship with money impacts your financial future and associated stress.

Last year, T. Rowe Price conducted a survey that reaffirms how financial stress strongly indicates your financial well-being.[i] A great deal of pressure was derived from the accumulation of debt and those who continue to increase their financial liabilities save less for retirement than those who are not stressed. Formulating a well-structured spending plan is the best way to reduce these tensions.

Mastering Money: The Key to Control, Clarity, and Financial Freedom

It makes sense—having a spending plan is a tool that puts you in control of your life through greater clarity and less fear. And if we are honest with ourselves, we can acknowledge whether we are inherently spenders or savers to some degree. But even with that awareness, how many of us fully comprehend how money shapes the course of our lives?

Every person has Money Energy; many don’t know it, and fewer understand it, but it’s real. It presents itself in a variety of ways:

- A racing heart when you realize the repercussions of overspending,

- Receiving an unexpected bill and not having enough money to cover it.

- Diagnosed with an illness and discovering the out-of-pocket expenses you will bear.

- When a family or friend is in financial trouble, you are in no position to help.

- Successfully accumulated wealth but seem incapable of holding on to it.

The energy of money and our emotions are in every decision we make—and the best part is it can be revealed and measured. Most financial planning tools are missing this key ingredient that can help you develop more effective spending, saving, and investment plans.

Harnessing the power

Money Energy is the power and capacity to generate wealth, which becomes a stored force that is releasable to your life at any time. It feeds your very life being. It enables you to achieve more and reduce barriers to achieving financial wellness. But first, you need to be able to recognize it for yourself. Foundational to your level of Money Energy is your ability to increase your Financial Behavior Capability.

Managing your spending and improved savings habits lead to more opportunities, which, combined to form your Money Relationship Integration, may open the doors to quantum leaps in generating wealth.

To illustrate, I’d like to familiarize you with Kim Grant, a 39-year-old creative director in an advertising agency. She and her husband Geoff have been in previous marriages, which has evolved their relationship with money. When they married, Kim and Geoff agreed to hold some shared investments, like their home, but keep all personal investments separate.

More recently, Kim met with her new financial advisor and explained that she is seeking to improve her spending and investment plan. Her advisor recommends going through the DNA Natural Behavior Discovery process, the foundation of a behaviorally driven goals-based planning process.

A quick review of Kim’s scores shows her to have an Adapter DNA Style based on her:

- Risk behavior

- Financial relationship management

- Financial planning management

- Wealth building motivation

- Financial emotional intelligence

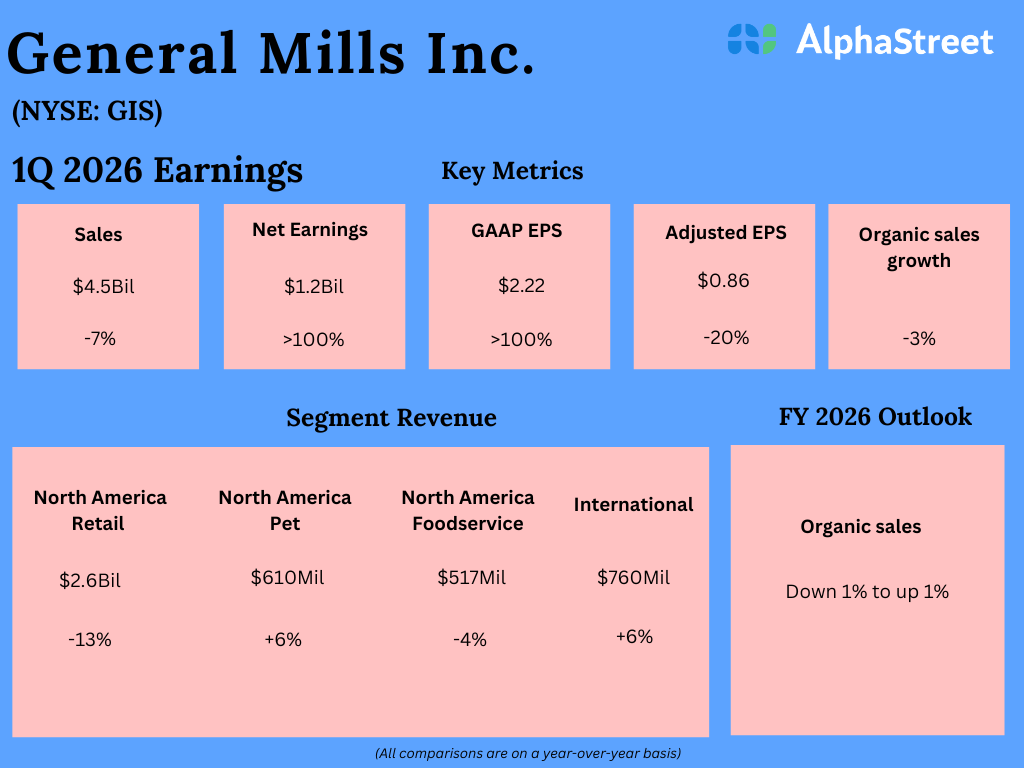

Based on her scores, Kim can adapt to the needs of her existing lifestyle and leverage or work on avoiding behaviors that can either help or hurt her success. One of the facets of the process is revealing her Financial Behavior Capability (FBC,) and Money Energy (ME). The table below reflects her unique discovery.

These natural DNA Behavior elements revealed are what the person has said about themself through the objectivity of the DNA Natural Behavior Discovery Process. The advisor can now speak to specific areas of Kim’s relationship with money that will inform the spending, saving, and budgeting plan she wants. However, a word of caution: What someone says about themself does not necessarily reflect whether they are financially wealthy, even when the scores may indicate a natural predisposition for wealth generation.

The ultimate ability to create wealth will also depend on the person’s skills or expertise learned through life, the decisions made, and the opportunities created or eventuated during their life journey. It goes beyond awareness and positive thinking. There must be positive action, and in this case, Kim must incorporate the financial discipline to manage her spending to increase her savings. It’s all part of the behavioral insights and Money Energy that inform a successful financial plan.

Stay tuned every week as we continue to reveal all 40 Laws of Money Energy. And if you seriously want to improve your money energy or incorporate it into your life, make it part of your leadership strengths or to improve your coaching techniques, I hope you’ll join one of our free upcoming webinars. Isn’t it time you learned an improved method to achieve better financial wellbeing?

[i] Financial Stress is a Predictor of Your Financial Wellness. T.Rowe Price. August 2022

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.