(Bloomberg) — Taiwan Semiconductor Manufacturing Co. raised its 2022 income forecast whereas warning it is going to trim spending on enlargement by as a lot as 9% from preliminary projections, reflecting uncertainty about electronics demand within the face of a possible international recession.

Most Learn from Bloomberg

Chief Govt Officer C. C. Wei warned on Thursday it was too early to enter specifics about spending plans or the outlook for semiconductor demand in 2023 ought to clients delay purchases. However TSMC ought to nonetheless get pleasure from “a progress 12 months,” the chief mentioned.

The strikes from Apple Inc.’s most necessary chipmaker replicate expectations that demand for every part from telephones to vehicles could stay resilient in 2022, although mounting inflation and waning client sentiment could exert an as-yet unsure impression going into 2023. TSMC’s function because the world’s predominant producer of superior semiconductors for iPhones and datacenters ought to probably cushion its revenue margins, executives mentioned.

“We anticipate our clients will begin to take motion to lower their stock degree. Just a few quarters, no less than into the primary half of 2023, they’ll proceed to do a listing correction,” Wei informed analysts on a convention name. “Our clients’ demand continues to exceed our capability to produce. We anticipate our capability to be tight by means of the top of 2022.”

Click on right here for a rundown of TSMC’s earnings name.

The world’s largest contract chipmaker is now projecting gross sales progress within the mid-30% vary, up from about 30% beforehand. It additionally projected income of $19.8 billion to $20.6 billion for the September quarter, beating estimates for roughly $18.5 billion.

But it surely additionally plans to delay capital spending, an indicator of its expectations for longer-term demand. TSMC mentioned its capital expenditure ought to are available on the decrease finish of a beforehand focused vary of $40 billion to $44 billion, citing longer occasions for gear supply. Requested how a lot of that reduce will make it into 2023, executives mentioned it was too early to inform.

The Taiwanese big harassed it is going to forge forward with plans to construct abroad crops, together with an envisioned $12 billion Arizona base that the Trump administration hailed as a triumph in endeavors to convey superior chipmaking again to America. However executives warned the prices had confirmed very excessive and TSMC wanted to search out methods to scale back that overhead, together with by means of federal subsidies.

Lawmakers are at the moment debating a plan to infuse $52 billion of incentives for US chipmaking, an formidable effort at enhancing analysis and growth to counter China’s rising financial affect.

Learn extra: Biden Group, High Democrat See Slimmer Invoice Key to Chips Funding

On Thursday, TSMC booked NT$237 billion ($7.9 billion) in internet revenue for the quarter ended June, surpassing the common estimate of NT$219.8 billion. Income jumped 44% to NT$534.1 billion within the second quarter, as beforehand reported. Its gross margin of 59.1% was the very best in 26 years, based mostly on knowledge compiled by Bloomberg.

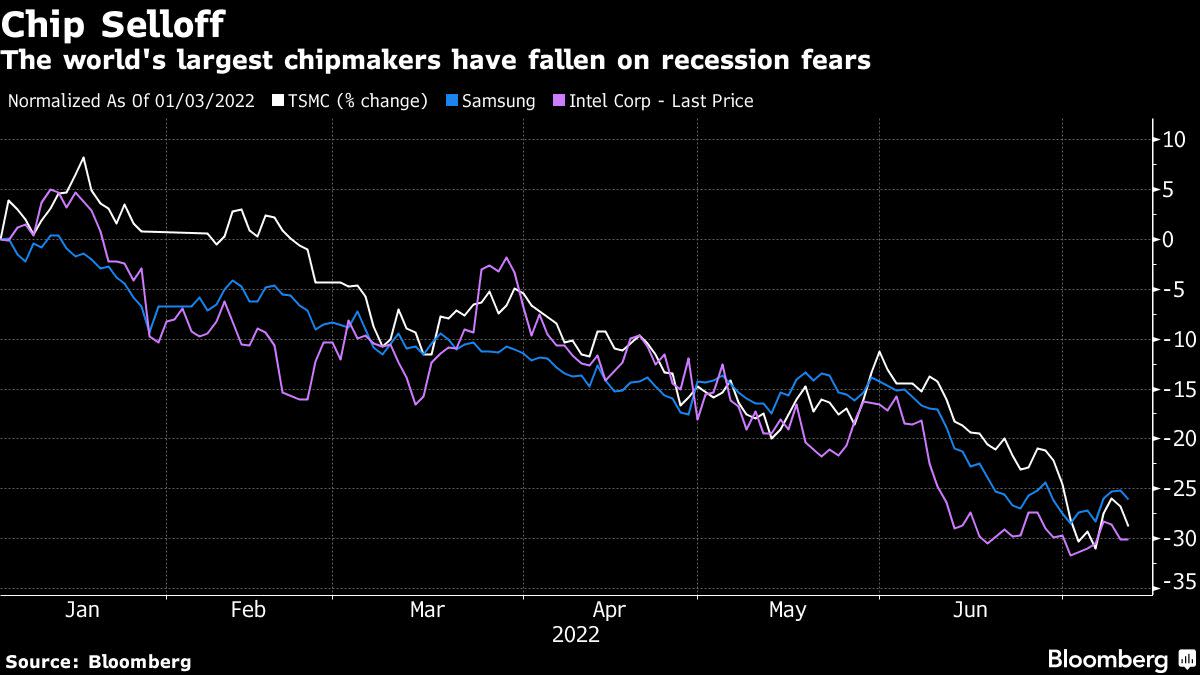

Issues persist about rising inventories within the $550 billion semiconductor trade and the longer-term impression of a possible international recession. TSMC’s shares are down greater than 20% this 12 months alongside a sector-wide selloff.

However Credit score Suisse analysts together with Randy Abrams mentioned TSMC remained one in all their prime picks due to its market share positive aspects and dominant place.

It has additionally benefited from its most necessary buyer. A lot will depend upon how shoppers take to Apple’s newest iPhone, anticipated to hit cabinets earlier than the year-end vacation season. On Thursday, Wei mentioned he’s unconcerned about potential stock buildups of high-end smartphones.

The Taiwanese agency additionally continues to journey the auto trade’s rising demand for semiconductors as vehicles change into extra digitized.

Learn extra: TSMC Gross sales Soar 44% in One other Signal of Resilient Tech Demand

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.