The cryptocurrency trade experiences a basic shift as conventional finance and crypto infrastructure converge, with main gamers like Stripe, Robinhood, and PayPal integrating stablecoin and pockets applied sciences into their core choices. Regardless of the blockchain know-how market reaching over $30B in estimated dimension, legacy crypto pockets infrastructure continues to create bottlenecks for builders with outdated APIs, poor scalability, and safety compromises that forestall mainstream adoption. Turnkey addresses this problem by offering safe, scalable, and programmable crypto infrastructure for embedded wallets and onchain transaction automation, providing builders the power to create tens of millions of safe, non-custodial wallets instantly inside their purposes with out seed phrases or complicated UX. The corporate has pioneered using safe enclaves and Trusted Execution Environments (TEEs) to ship the primary verifiable key administration system of its variety, enabling seamless onboarding experiences whereas sustaining enterprise-grade safety. With their infrastructure now powering over 50 million embedded wallets and processing tens of millions of transactions weekly throughout use instances from DeFi and funds to AI brokers and client purposes, Turnkey has established itself as the muse enabling crypto’s evolution towards mainstream adoption.

AlleyWatch sat down with Turnkey CEO and Cofounder Bryce Ferguson to be taught extra in regards to the enterprise, its future plans, and up to date funding spherical, and far, way more…

Who have been your buyers and the way a lot did you increase?

Turnkey raised $30M in Sequence B funding, bringing the corporate’s complete funding to greater than $50M. Bain Capital Crypto led the spherical, with participation from Sequoia Capital, Lightspeed Faction, Galaxy Ventures, Wintermute Ventures, and Variant.

Inform us in regards to the services or products that Turnkey provides.

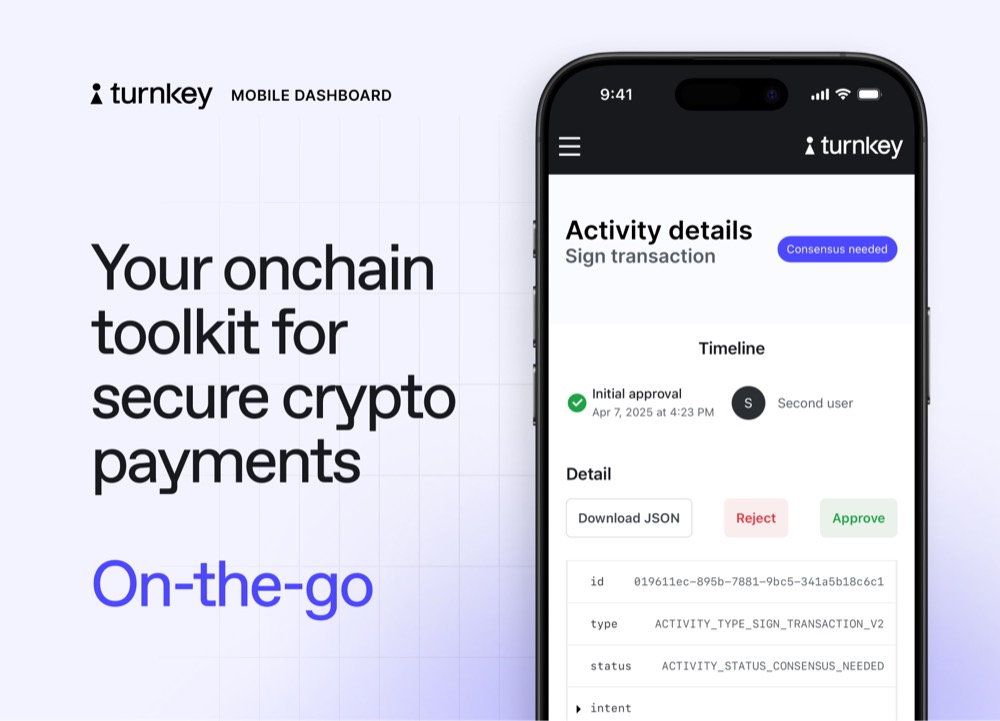

Turnkey gives safe, scalable, and programmable crypto infrastructure for embedded wallets and onchain transaction automation. Let me clarify each:

Embedded wallets: Most of the world’s fastest-growing crypto corporations, from Moonshot to Infinex to Magic Eden, have used Turnkey to create tens of millions of safe, non-custodial wallets on behalf of their clients, instantly inside their app. No seed phrases. No complicated UX. Simply seamless onboarding.

Transaction automation: Turnkey lets groups automate onchain workflows at scale with fine-grained management insurance policies. You may securely transfer property, approve actions, or set off transactions — all programmatically.

What impressed the beginning of Turnkey?

Jack Kearney (cofounder) and I met at Coinbase. We had usually talked about beginning an organization, however we imagined we’d want to cover out for months to determine what to construct. That wasn’t the case in any respect.

Beginning Turnkey occurred very naturally — it was an extension of the work we had been doing beforehand. We had constructed key administration infrastructure at Coinbase, and we had seen how the crypto trade was evolving. After Coinbase, after I was at Commerce Republic and Jack was at Polychain, we hit our heads in opposition to the wall integrating with current key administration options. We skilled firsthand the place this infrastructure was falling brief and noticed clear gaps available in the market.

So in 2022, we obtained collectively and began asking, “ought to we discover this somewhat bit extra?” Quickly after, we raised our seed spherical, introduced collectively outdated colleagues from Coinbase, and began to construct in the direction of our imaginative and prescient of infrastructure that may let builders programmatically management wallets and transactions with out compromising on safety.

How is Turnkey completely different?

The crypto trade strikes very, in a short time. On the use case facet, you could have crypto corporations targeted on rising areas like AI brokers for crypto buying and selling. On the adoption facet, crypto corporations can expertise sharp spikes in customers and transactions in a single day — like Moonshot after $TRUMP launched.

As a result of the crypto trade strikes so quick, infrastructure suppliers are too usually a bottleneck. Turnkey is the other — the safety, flexibility, and scalability constructed into our platform permits builders to construct unbelievable merchandise. Our platform is in-built such a means that we’re a future-proof possibility for builders that can enable them to evolve with the crypto trade.

From the start, Turnkey additionally took a really completely different strategy to safety. We leveraged safe enclaves, which have been a little-used device for crypto pockets safety again in 2022. In our early days of promoting Turnkey, there was an enormous schooling part for potential clients on what safe enclaves have been, and the way clients would profit from this safety strategy. Largely due to the work Turnkey did, safe enclaves at the moment are turning into the default when folks take into consideration key administration safety.

What market does Turnkey goal and the way massive is it?

Most instantly, Turnkey falls into the blockchain know-how market, with an estimated dimension of over $30B .

Within the coming years, although, I see the addressable market being considerably bigger. Already, we’ve billions of {dollars} in crypto transactions being powered by Turnkey’s infrastructure. As crypto turns into much more broadly adopted, and Turnkey scales to work with extra clients past the crypto-native, I anticipate processing trillions in crypto transactions.

What’s what you are promoting mannequin?

Turnkey’s pricing is a mixture of a month-to-month minimal, and per signature pricing that scales with quantity.

How are you getting ready for a possible financial slowdown?

I don’t see near-term indicators of a crypto slowdown. If something, I feel political and financial circumstances will consequence within the crypto trade scaling quickly over the subsequent few years. That being mentioned, our management workforce is taking the lengthy view on rising Turnkey. We acknowledge there might be downturns, and are investing in our workforce and infrastructure in a means that can enable us to climate any financial headwinds.

What was the funding course of like?

We truly weren’t actively fundraising when buyers got here knocking. Due to the expansion we’ve been seeing, buyers acknowledged the chance in what we’re constructing, and our fundraising course of was streamlined. Bain Capital Crypto specifically introduced deep technical experience, and shortly understood how necessary Turnkey’s infrastructure can be in bringing crypto to the lots.

What are the most important challenges that you just confronted whereas elevating capital?

As a result of Turnkey has taken a basically completely different strategy to key administration infrastructure, a lot of our early investor conversations targeted on resetting psychological fashions and clarifying the size of the chance.

What elements about what you are promoting led your buyers to write down the verify?

For Turnkey’s Seed and Sequence A rounds, buyers have been extra targeted on the energy of the workforce, and the potential for the know-how. For the Sequence B we simply raised, our buyers are each enthusiastic about our buyer traction, in addition to our long-term imaginative and prescient of programmable, open, and verifiable primitives that help real-world use instances.

What are the milestones you propose to realize within the subsequent six months?

Over the subsequent six months, we’ll double down on our core pockets infrastructure to make it simpler and simpler to construct in crypto. We’ll scale our workforce throughout engineering, product, go-to-market, and operations. We’ll additionally put money into open sourcing purposes, deeper integrations, and extra modular infrastructure for funds, AI brokers, DeFi, and extra.

What recommendation are you able to supply corporations in New York that wouldn’t have a recent injection of capital within the financial institution?

With the appearance of AI, it’s simpler than ever to construct with little or no sources. In case you imagine in your mission, preserve constructing till it’s inconceivable for VCs to disregard your product.

The place do you see the corporate going now over the close to time period?

Turnkey is scaling throughout the board — engineering, product, GTM. Our workforce can also be persevering with to put money into open supply and verifiability, increasing our integrations, and constructing extra modular infrastructure to help new use instances in funds, DeFi, AI brokers, and extra. Our purpose is for Turnkey to develop into the default infrastructure powering crypto transactions.

What’s your favourite spring vacation spot in and across the metropolis?

The second the solar comes out, yow will discover me working on the West Aspect Freeway!