Final yr marked the twenty fifth anniversary for Upfront Ventures and what a yr it was. 2021 noticed phenomenal returns for our business and it topped off greater than a decade of unprecedented VC development.

The business has clearly modified enormously in 2022 however in some ways it appears like a “return to regular” that we have now seen many occasions in our business. Yves Sisteron, Stuart Lander & I (depicted within the picture under) have labored collectively for greater than 22 years now and that has taken us by way of many cycles of market enthusiasm & panic. We’ve additionally labored with our Companion, Dana Kibler who can also be our CFO for practically 20 years.

We consider this consistency in management and instinct for the place the markets had been going within the heady days of 2019–2021 helped us to remain sane in a world that momentarily appeared to have misplaced its thoughts and since we have now new capital to deploy within the years forward maybe I can supply some insights into the place we predict worth shall be derived.

Whereas the headlines in 2020 & 2021 touted many large fundraising occasions and heady valuations, we believed that for savvy buyers it additionally represented a chance for actual monetary beneficial properties.

Since 2021, Upfront returned greater than $600 million to LPs and returned greater than $1 billion since 2018.

Contemplating that lots of our funds are within the $200–300 million vary, these returns had been extra significant than if we had raised billion greenback funds. We stay assured within the long-term pattern that software program allows and the worth accrued to disruptive startups; we additionally acknowledged that in a powerful market you will need to ring the money register and this doesn’t come with out a concentrated effort to take action.

Clearly the funding setting has modified significantly in 2022 however as early-stage buyers our every day jobs keep largely unchanged. And whereas over the previous few years we have now been laser-focused on money returns, we’re equally planting seeds for our subsequent 10–15 years of returns by actively investing in immediately’s market.

We’re excited to share the information that we have now raised $650 million throughout three autos to permit us to proceed making investments for a few years forward.

We’re proud to announce the shut of our seventh early-stage fund with $280 million to take a position in seed and early stage founders.

Alongside Upfront VII we’re additionally now deploying our third growth-stage fund, which has $200 million in commitments and our Continuation Fund of greater than $175 million.

A query I typically hear is “how is Upfront altering given the present market?” The reply is: not a lot. Previously decade we have now remained constant, investing in 12–15 firms per yr on the earliest phases of their formation with a median first verify dimension of roughly $3 million.

If I look again to the start of the present tech growth which began round 2009, we regularly wrote a $3–5 million verify and this was known as an “A spherical” and 12 years later in an over-capitalized market this turned often called a “Seed Spherical” however in fact what we do hasn’t modified a lot in any respect.

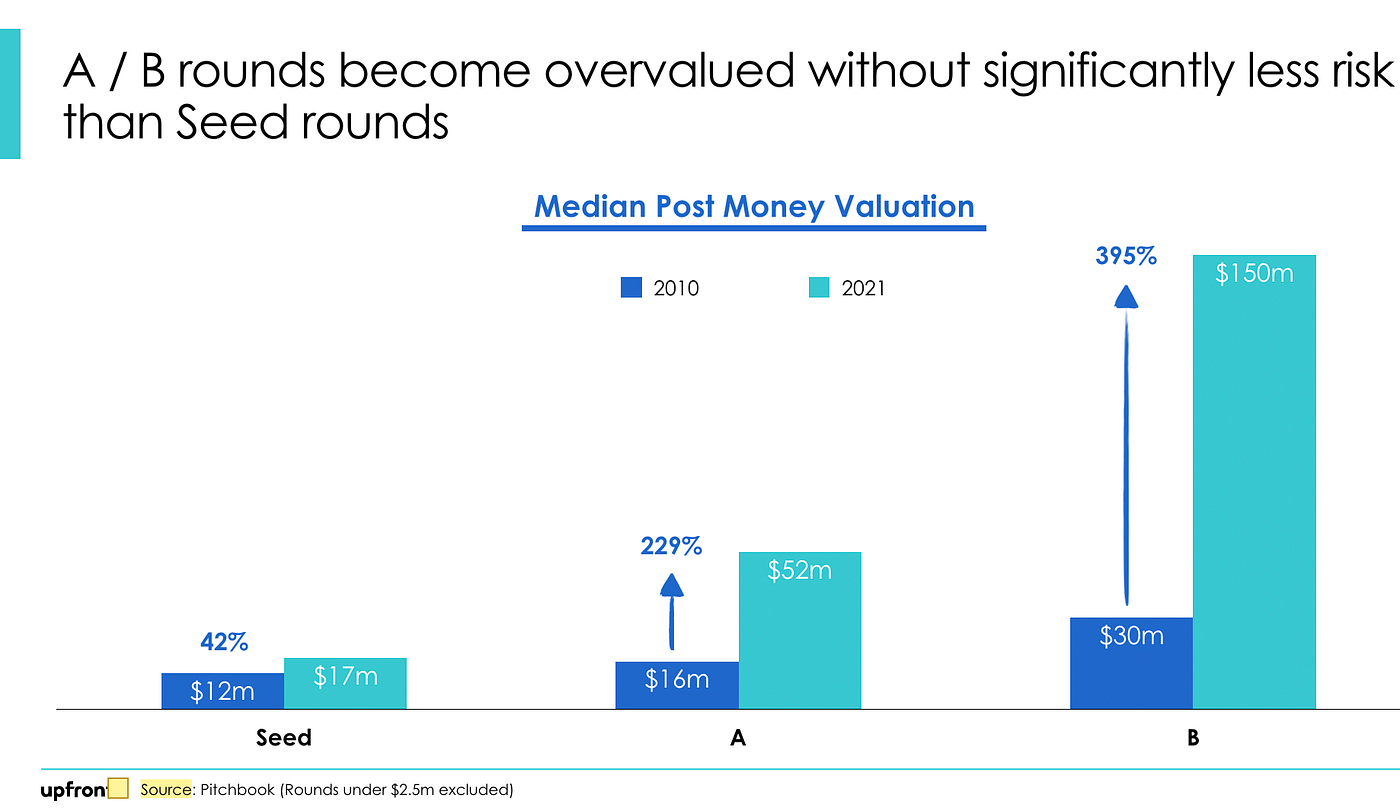

And should you take a look at the above knowledge you may see why Upfront determined to remain targeted on the Seed Market reasonably than elevate bigger funds and try to compete for A/B spherical offers. As cash poured into our business, it inspired many VCs to jot down $20–30 million checks at more and more increased and better valuations the place it’s unlikely that that they had substantively extra proof of firm traction or success.

Some buyers might have succeeded with this technique however at Upfront we determined to remain in our lane. Actually, we revealed our technique a while in the past and introduced we had been transferring to a “barbell technique” of funding on the Seed degree, largely avoiding the A/B rounds after which rising our investments within the earliest phases of know-how development.

Once we get entangled in Seed investments we often signify 60–80% in one of many first institutional rounds of capital, we nearly all the time take board seats after which we serve these founders over the course of a decade or longer. In our best-performing firms we regularly write follow-on checks totaling as much as $10–15 million out of our early-stage fund.

Starting in 2015 we realized that the very best firms had been staying personal for longer so we began elevating Progress Automobiles that might put money into our portfolio firms as they received larger however might additionally put money into different firms that we had missed on the earliest phases and this meant deploying $40–60 million in a few of our highest-conviction firms.

However why have we determined to run separate funds for Seed and for Early Progress and why didn’t we simply lump all of it into one fund and make investments out of only one automobile? That was a query I had been requested by LPs in 2015 once we started our Early Progress program.

In brief,

In Enterprise Capital, Measurement Issues

Measurement issues for a number of causes.

As a place to begin we consider it’s simpler to persistently return multiples of capital once you aren’t deploying billions of {dollars} in a single fund as Fred Wilson has articulated persistently in his posts on “small ball” and small partnerships. Like USV we’re often investing in our Seed fund when groups are fewer than 10 workers, have concepts which are “on the market” and the place we plan to be actively engaged for a decade or longer. Actually, I’m nonetheless energetic on two boards the place I first invested in 2009.

The opposite argument I made to LPs on the time was that if we mixed $650 million or extra right into a single fund it could imply that writing a $3–4 million would really feel too small to every particular person investor to be essential and but that’s the quantity of capital we believed many seed-stage firms wanted. I noticed this at a few of my friends’ corporations the place more and more they had been writing $10+ million checks out of very massive funds and never even taking board seats. I feel in some way the bigger funds desensitized some buyers round verify sizes and incentivized them to seek for locations to deploy $50 million or extra.

In contrast, our most up-to-date Early Progress fund is $200 million and we search to jot down $10–15 million into rounds which have $25–75 million in capital together with different funding corporations and each dedication actually issues to that fund.

For Upfront, constrained dimension and excessive group focus has mattered.

What has shifted for Upfront up to now decade has been our sector focus. Over the previous ten years we have now targeted on what we consider shall be an important tendencies of the following a number of many years reasonably than concentrating on what has pushed returns up to now 10 years. We consider that to drive returns in enterprise capital, it’s important to get three issues appropriate:

- It’s worthwhile to be proper in regards to the know-how tendencies are going to drive society

- It’s worthwhile to be proper in regards to the timing, which is 3–5 years earlier than a pattern (being too early is similar as being mistaken & should you’re too late you typically overpay and don’t drive returns)

- It’s worthwhile to again the successful group

Getting all three appropriate is why it is vitally troublesome to be wonderful at enterprise capital.

What meaning to us at Upfront immediately and transferring ahead with Upfront VII and Progress III is a deeper focus on these classes the place we anticipate essentially the most development, essentially the most worth creation, and the most important influence, most particularly:

- Healthcare & Utilized Biology

- Protection Applied sciences

- Laptop Imaginative and prescient

- Ag Tech & Sustainability

- Fintech

- Consumerization of Enterprise Software program

- Gaming Infrastructure

None of those classes are new for us, however with this fund we’re doubling down on our areas of enthusiasm and experience.

Enterprise capital is a expertise recreation, which begins with the group that’s inside Upfront. The Upfront VII and Progress groups are made up of 10 companions: 6 main funding actions & 4 supporting portfolio firms together with Expertise, Advertising and marketing, Finance & Operations.

Most who know Upfront are conscious that we’re primarily based out of Los Angeles the place we deploy ~40% of our capital however as I wish to level out, meaning nearly all of our capital is deployed exterior of LA! And the primary vacation spot exterior of LA is San Francisco.

So whereas some buyers have introduced they’re transferring to Austin or Miami we have now truly been rising our investments in San Francisco, opening an workplace with 7 funding professionals that we’ve been slowly constructing over the previous few years. It’s led by two companions: Aditi Maliwal on the Seed Funding Workforce who additionally leads our Fintech observe and Seksom Suriyapa on the Progress Workforce who joined Upfront in 2021 after most not too long ago main Corp Dev at Twitter (and earlier than that at Success Components and Akamai).

So whereas our investing platform has grown in each dimension and focus, and whereas the market is transitioning into a brand new and doubtlessly more difficult actuality (at the very least for a number of years) — in an important methods, Upfront stays dedicated to what we’ve all the time targeted on.

We consider in being energetic companions with our portfolio, working alongside founders and government groups in each good occasions and in more difficult occasions. Once we make investments, we decide to being long-term companions to our portfolio and we take that accountability severely.

We have now sturdy views, take sturdy positions, and function from a spot of sturdy conviction once we make investments. Each founder in our portfolio is there as a result of an Upfront companion had unwavering perception of their potential and did no matter it took to get the deal accomplished.

We’re so grateful to the LPs who proceed to belief us with their capital, time and conviction. We really feel blessed to work alongside startup founders who’re actually rising to the problem of the harder funding setting. Thanks to everyone in the neighborhood who has supported us all these years. We’ll proceed to work arduous to make you all proud.

Thanks, thanks, thanks.