imaginima

Upstart Holdings, Inc. (NASDAQ:UPST) revealed preliminary outcomes for its second quarter yesterday, and to name the income determine a disappointment could be a gross misunderstanding of actuality.

The corporate’s income progress has slowed considerably, and the ‘kitchen-sinking’ of 2Q-22 outcomes has added to Upstart’s earlier valuation losses.

Sadly, I used to be incorrect about Upstart and imagine that the corporate’s funding thesis has successfully gone.

Preliminary Outcomes Have been A Catastrophe

Upstart’s inventory has been down 78% year-to-date, and the announcement of preliminary second quarter numbers, which may be seen right here, will virtually actually add important promoting stress to the inventory within the close to future.

What was so horrible in regards to the preliminary launch of 2Q-22 financials?

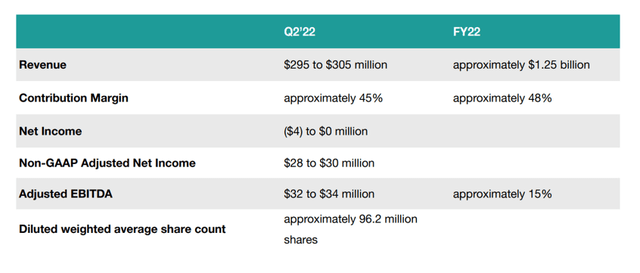

Upstart missed its gross sales forecast for the second quarter by a large margin. The AI-lending enterprise, which makes use of synthetic intelligence expertise to automate the lending determination course of, deliberate for revenues of $295 to $305 million however solely reported unaudited 2Q-22 revenues of $228 million.

The steering was diminished on account of decrease demand for the corporate’s loans, in addition to elevated threat aversion in a market fueled by increased rates of interest and inflation. The Fintech additionally said that it transformed loans on its stability into money, leading to a income lower within the second quarter. Extra info concerning Upstart’s gross sales efficiency in 2Q-22 will probably be accessible solely after the Fintech studies its earnings.

The reported result’s 23% decrease than the low-end ($295 million) of steering, or $67 million beneath Upstart’s low-end gross sales estimate only a quarter in the past. Moreover, the AI enterprise forecasts web income to be within the ($31)-($27) million space, after beforehand implying that Upstart had an opportunity of incomes a black zero within the second quarter. The earlier steering projected a web earnings vary of ($4) to $0 million.

In my view, the pre-release is an try to ‘kitchen-sink’ the quarter and put together the market not just for a slowing in gross sales progress sooner or later but additionally for the prospect that the agency would not have the ability to perform financially.

One of many fundamental causes I preferred and urged Upstart was that the corporate generated income rapidly (156% YoY in 1Q-22) whereas additionally attaining worthwhile progress. The presence of web earnings ($32.7 million in 1Q-22) distinguished Upstart from different Fintech corporations, a lot of whom are nonetheless dropping cash. With Upstart’s pre-release of 2Q-22 outcomes on July 7, these distinct traits fully vanished into skinny air.

The affect for Upstart buyers is that the AI mortgage firm may also withdraw its 2022 income steering when it publicizes its full 2Q-22 earnings after the market ends on August 8, 2022. The income steering for 2022 was $1.25 billion, which is not attainable.

Upstart has already diminished its income projection for 2022, down from $1.40 billion in doable gross sales this yr to $1.25 million. Whereas contribution margins are predicted to stay steady within the second quarter, Upstart’s progress prognosis has deteriorated considerably this week.

2022 Income Steerage (Upstart Holdings)

Upstart Is Set For A Correction

The worst factor that may occur to a progress inventory like Upstart is for income steering to be withdrawn within the face of a extra antagonistic macro surroundings. The market continues to be forecasting $1.25 billion in gross sales for 2022, however Upstart is nearly anticipated to withdraw this steering when earnings for the second quarter are reported subsequent month.

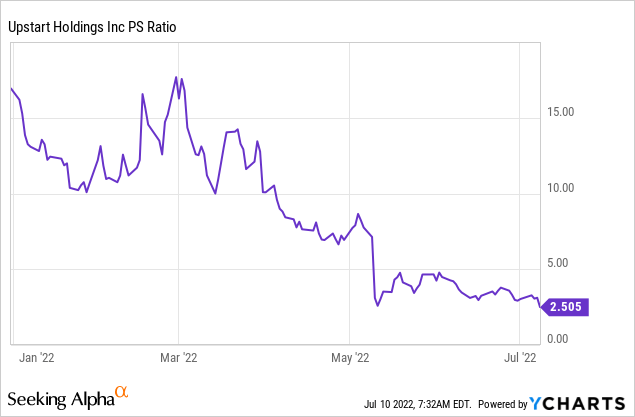

I imagine that recent steering will probably be issued in August, with a revised income baseline of $1.0 billion. Upstart’s gross sales a number of is 2.5x, nonetheless, the inventory may grow to be considerably extra expensive within the subsequent days as a result of unsure income place.

Why Upstart Holdings May See An Enhance In Valuation

Although the general opinion has grown extremely gloomy, new alliances or acquisitions could have a helpful affect on investor sentiment.

The announcement of preliminary figures crushed the funding thesis, and I imagine the inventory value will face enormous stress sooner or later. A major shopper acquire or collaboration with a financial institution or credit score union may additionally assist to mitigate the worsening in investor opinion.

My Conclusion

Upstart’s early second quarter numbers undoubtedly rocked the boat, and never in a great way. The earnings shortfall was just too massive, particularly provided that Upstart had already diminished its income forecast for 2022.

Upstart’s short-term income prospects have deteriorated considerably, and buyers have little to look ahead to when the total second quarter earnings report is launched in August.

Having mentioned that, I used to be sadly incorrect in endorsing Upstart, even though I imagine the agency has a robust place in its AI-lending specialty. Upstart’s funding case has sadly died.