PhanuwatNandee

Introduction to the ProShares Extremely VIX Brief-Time period Futures ETF

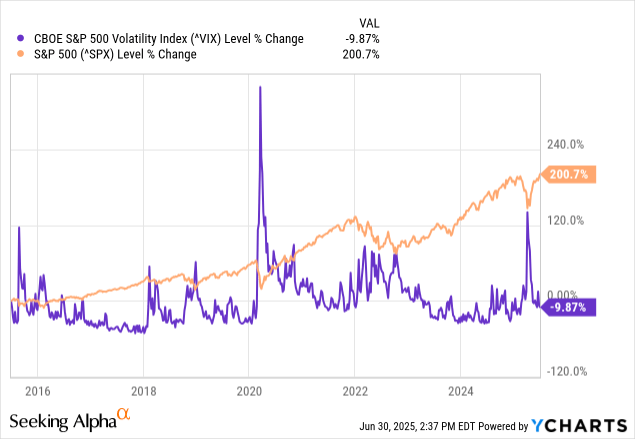

For a lot of buyers, the primary time they’re launched to the idea of volatility is thru the CBOE Volatility Index or “VIX”, a non-investible index that tracks the speed of choices within the S&P 500, basically its “volatility degree”, or because it was put greatest to me, a tough gauge of demand for S&P 500 put choices (draw back insurance coverage).

See this hyperlink for particulars from CBOE itself on the VIX. They’ve a fantastic 3-minute explainer video on it.

Naturally, which means that throughout sudden crashes or drops out there that come out of nowhere, the VIX spikes sharply.

This phenomenon has meant that buyers use VIX-related devices as portfolio hedges, basically betting on profitable massive throughout a black swan occasion.

Enter the ProShares Extremely VIX Brief-Time period Futures ETF (BATS:UVXY), which presents buyers an investible fund that tracks not solely the VIX however 1.5x the each day motion of the VIX.

The fund has over $600M in AUM and carries a 0.95% expense ratio.

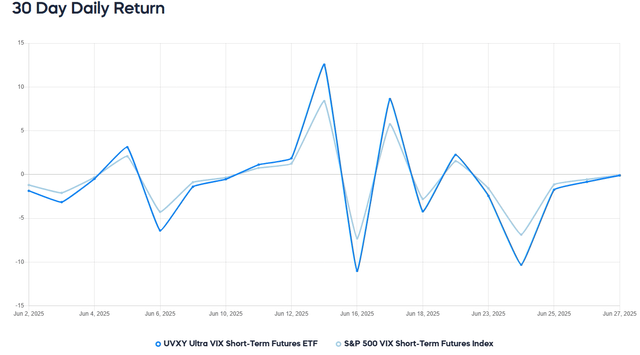

The leverage results in exaggerations in worth swings, which one can see very clearly in a short-term 30-day chart. The each day resetting nature of the fund makes it in order that UVXY is unlikely to maintain up 1.5x over longer timeframes, and even intraday.

ProShares

A Warning About Leverage

There are three warnings that I feel buyers ought to take into account when any daily-resetting leveraged fund:

1) The SEC notes:

Leveraged and inverse ETFs are sometimes designed to attain their acknowledged efficiency targets each day. Some buyers may put money into these ETFs with the expectation that the ETFs might meet their acknowledged each day efficiency targets over the long run as properly. Buyers ought to be conscious that the efficiency of those ETFs over a interval longer than at some point can differ considerably from their acknowledged each day efficiency targets and will probably expose buyers to vital and sudden losses.

2) UVXY’s prospectus notes:

The usage of leveraged... positions will increase danger and will outcome within the whole lack of an investor’s funding inside a given day…

[UVXY is] supposed for use as a buying and selling device for short-term funding horizons, and buyers holding shares of the Funds over longer-term intervals could also be topic to elevated danger of loss…

For instance, as a result of the... Fund features a one and one-half occasions (1.5x) multiplier, a single-day motion within the Index approaching 66.7% at any level within the day might outcome within the whole loss or virtually whole lack of an funding within the Fund... This could be the case with downward single-day or intraday actions within the Index, even when the Index maintains a degree higher than zero always and even when the Index subsequently strikes in an other way, eliminating all or a portion of the prior adversarial motion…

3) This assessment of MSTX, the “Case Examine For Dangerous Leveraged ETFs” might be considered as a cautionary story.

UVXY Efficiency

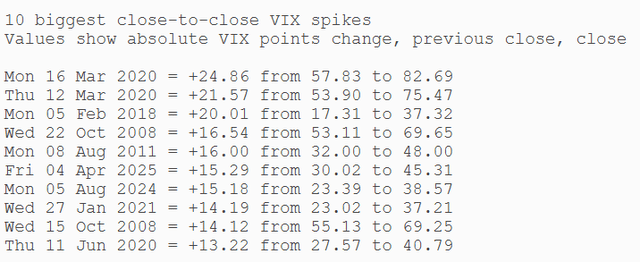

On the purpose in #2 from the final part, I wished to see in VIX historical past if a 66.7% intraday drop has ever occurred, even earlier than UXVY’s existence, simply to see if there’s a precedent for an occasion that might’ve blown up the fund.

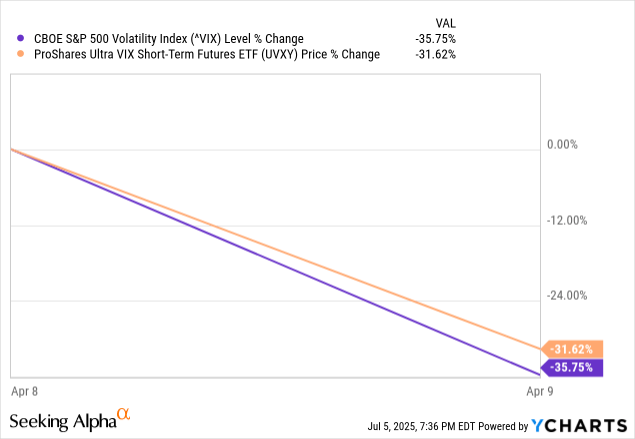

The report for the biggest one-day VIX drop was set on April 9, 2025, when the S&P 500 spiked following Liberation Day tariff postponements. On that day, the VIX fell over 35%, and UVXY failed to fulfill its goal that day.

For the report, failing on that day ended up as a optimistic for shareholders, because the fund had some draw back padding within the sudden drop, though it nonetheless fell over 30%. A lot better than the anticipated 50%+ drop, assuming the 1.5x multiplier held by way of the drop.

That is an instance of how the fund might deviate from its targets, particularly in excessive market circumstances like these in April 2025.

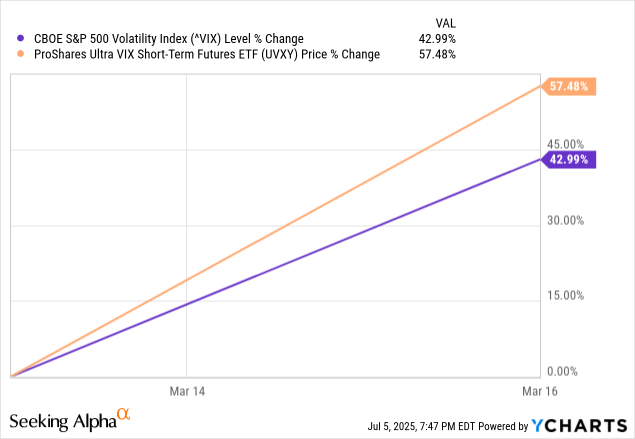

On the flip facet, UVXY did get very near attaining its goal on the dates of the biggest one-day upward motion within the VIX, March 16, 2020. Notice that this chart begins on the Friday earlier than to indicate the total motion.

For these curious, here’s a record of the assorted all-time largest one-day spikes within the VIX, if you wish to evaluate how UVXY did on these dates to see how usually it matches as much as its goal.

MacroOption

Simply notice that the fund is variable in its efficiency and in assembly its goal, as the way in which it builds out the 1.5x publicity is advanced and employs a really heavy use of derivatives.

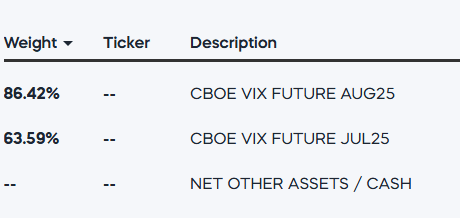

UVXY Holdings

Futures are advanced, and their intricacies are out of the scope of this text, however they’re a mandatory matter to cowl as a result of they’re everything of the fund’s holdings.

ProShares

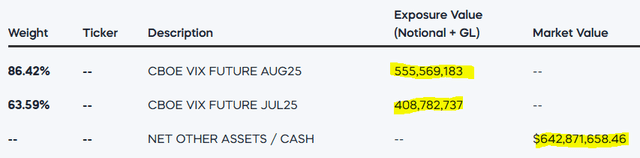

The trade time period is “capital effectivity”, which is a phrase that the trade got here up with to keep away from “leverage”, however the concept with futures is you could get extra publicity to an asset than the capital you set up for the long run. This enables the fund to spend 100% of its belongings on futures and obtain 150% publicity to the underlying asset of these futures, i.e., the VIX.

These futures are reset each day to make sure that UVXY retains up its each day goal. Notice that futures don’t transfer linearly with the costs of their underlying belongings, particularly when volatility is heightened, and this dynamic creates the setting the place UVXY might or might not obtain its goal on any given day. It isn’t essentially as much as ProShares’ administration, however how the futures market reacts to modifications within the underlying asset.

All of that’s to clarify why we see a market worth of $642,871,658.46 on the holdings however a notional worth of $964,351,920 when trying on the worth of the futures contracts. Notice that these are simply instance figures taken at one given second in time, and the fund modifications its positions each day.

ProShares

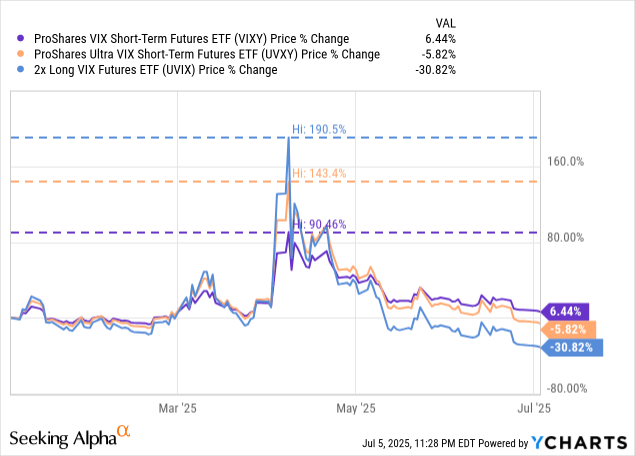

UVXY vs. Friends

There are a number of VIX-following and leveraged VIX funds in the marketplace, and all of them function equally to UVXY by utilizing futures to safe publicity to the VIX index.

| Ticker | Identify | Leverage |

| VIXY |

ProShares VIX Brief-Time period Futures ETF |

1x |

| UVXY | ProShares Extremely VIX Brief-Time period Futures ETF | 1.5x |

| UVIX | 2x Lengthy VIX Futures ETF | 2x |

After all, these funds all transfer equally over time, with the variations principally being within the quantity of leverage employed. Buyers utilizing VIX ETFs to hedge are likely to skew towards the leverage to allow them to use much less capital on the hedge, however that additionally provides extra danger to the person place. The trade-offs are as much as the investor.

One factor we do notice is that whereas all these funds are likely to decay over time, as anticipated with a fund’s lengthy volatility, the peaks they can hit throughout huge spikes within the VIX immediately correlate to how a lot danger they pose.

UVXY Suitability

All of this begs the query: how do buyers make use of UVXY, and which buyers may gain advantage from utilizing it?

The way in which I see it, the fund is probably the most usable as a hedging device because it tends to spike throughout market declines. It is usually greatest used as a tactical device that’s introduced out and in of a portfolio as wanted to hedge market circumstances. This will or is probably not a hedge employed on a regular basis because it tends to decay; nonetheless, it could be helpful in that function if a strict rebalancing technique, both timed or by bands, is employed with it.

Buyers eager to guess on rising volatility are in a position to take a “massive swing with a small guess”, so to talk, utilizing the leverage that UVXY presents. Warning is prudent right here, as that is another ETF that’s not meant to be purchased and held long run with out one other use or technique connected to it.

Conclusion

In the end, buyers wanting to guard their draw back from sudden volatility might use the ProShares Extremely VIX Brief-Time period Futures ETF as a singular hedging device, counting on its leverage and responsiveness to the VIX to offset sudden and steep losses in equities markets.

Whereas this has traditionally been a worthwhile technique, mistiming or poor place sizing might trigger outsized losses for buyers; warning is suggested when approaching each alternate options, akin to lengthy volatility funds and leverage itself.

That is an ETF that buyers ought to fastidiously take into account and thoughtfully assemble a technique round, because it is not a “purchase and maintain” fund, per se.

Thanks for studying.

This text solutions these three important questions on UVXY:

- Is UVXY a great device for hedging an fairness portfolio?

- Ought to buyers anticipate to make use of a “purchase and maintain” technique with UVXY?

- How a lot leverage does UVXY present?

Editor’s notice: This text is meant to supply a normal overview of the ETF for instructional functions solely and, in contrast to different articles on Looking for Alpha, doesn’t supply an funding opinion concerning the ETF.