IvelinRadkov

The Vanguard Small-Cap Value ETF (NYSEARCA:VBR) is a simple, cheap, strong, U.S. small-cap value index ETF. VBR’s cheap valuation and recent outperformance make the fund a buy.

VBR – Basics

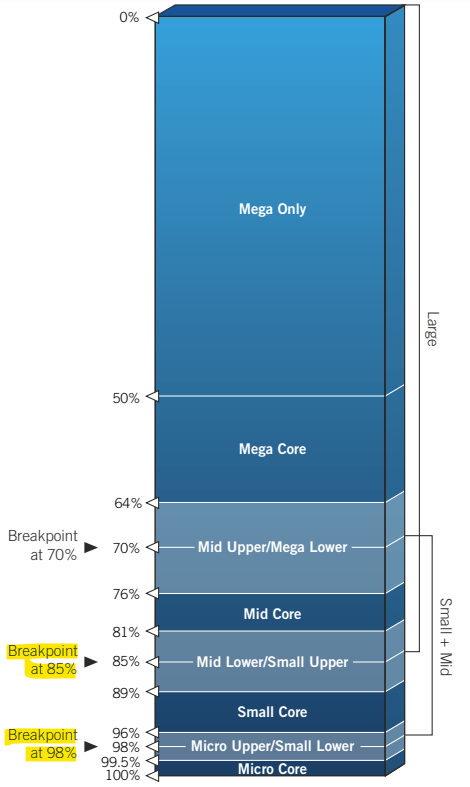

VBR is an equity index ETF investing in U.S. small-cap value equities. It tracks the CRSP U.S. Small Cap Value Index, an index of these same securities. Said index starts by selecting applicable small-cap equities, defined as those whose market-cap accounts for the bottom 85% – 98% of total U.S. market-cap. So, bottom 15%, but excluding the smallest 2%, which are classified as micro-cap stocks instead. The following graph summarizes the relevant securities, check the breakpoints in the left.

CRSP

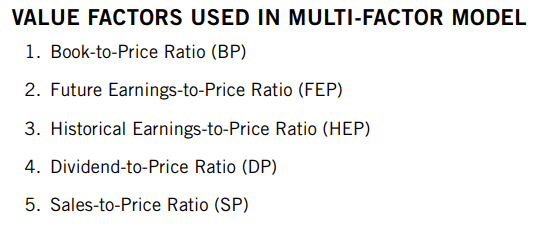

From applicable small-cap stocks, the index then selects the cheapest of these, based on the following standard value metrics.

CRSP

As with most other indexes, applicable securities must meet a basic set of criteria to be included in the portfolio. There are also a set of buffers and other assorted rules meant to reduce portfolio turnover. In general terms, VBR’s underlying index is sound, effective, and does not suffer from any significant issues or negatives. In my opinion, at least.

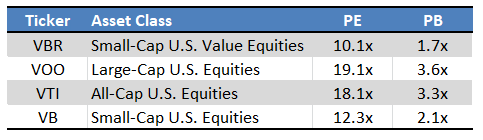

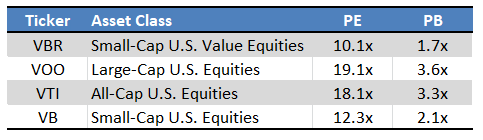

VBR’s underlying index is effective at selecting cheap value stocks, as evidenced by the fund’s below-average valuation.

Fund Filings – Chart by Author

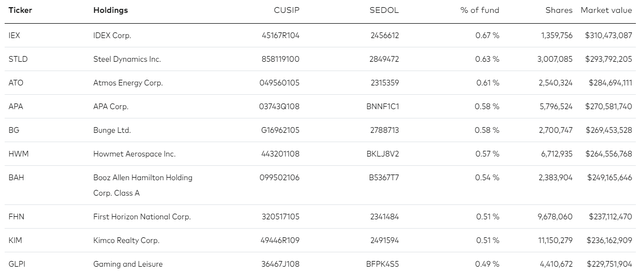

VBR’s underlying index is reasonably broad, which results in a well-diversified fund, with investments in almost 900 securities, and with exposure to most industry segments. Largest holdings and industry segments are as follows.

VBR VBR

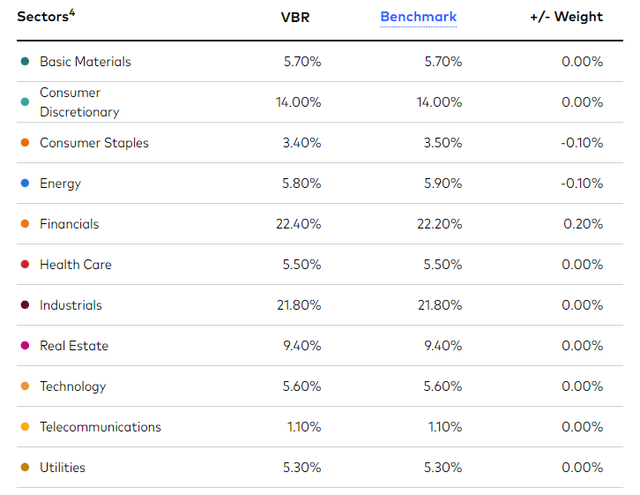

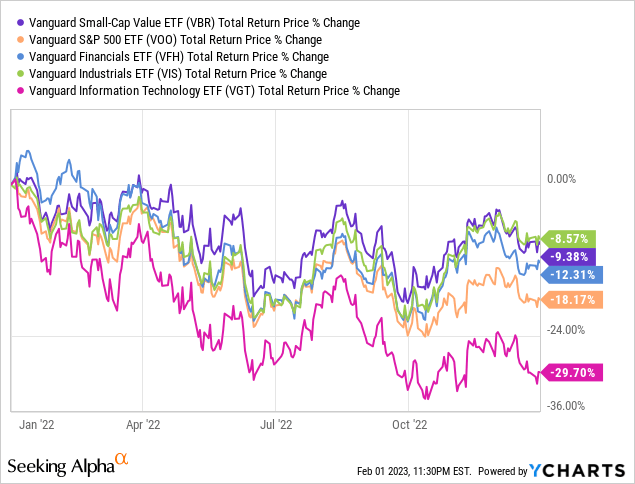

As most other small-cap and value funds, VBR is overweight cheap, old-economy industries, especially financials and industrials, while being underweight expensive growth tech. Due to this, VBR’s performance relative to broader equity indexes is somewhat dependent on the relative performance of these sectors. VBR outperforms when financials and industry outperform, and tech underperforms, as was the case in 2022.

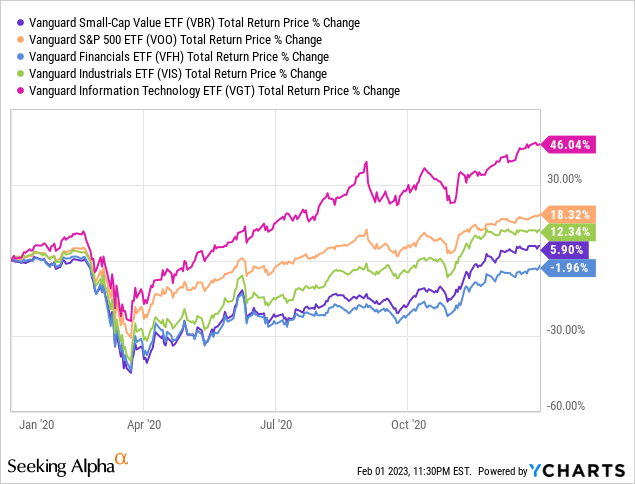

VBR underperforms when tech outperforms while financials and industrials lag behind, as was the case during 2020.

VBR’s industry exposures are neither a negative nor a positive, but they are an important fact for investors to consider. VBR might not be appropriate for tech bulls or investors looking for funds with significant tech positions, for instance.

VBR – Valuation Analysis

VBR’s key selling point is its cheap valuation. The fund focuses on small-cap equities, which tend to trade with discount valuations relative to large-caps, due to greater (perceptions of) risk. The fund further focuses on small-cap value equities, or those with comparatively cheap valuations. The result is an incredibly cheap portfolio, with a PE ratio of 10.7x, and a PB ratio of 1.8x. Both figures are significantly below-average for a broad-based equity index fund, with VBR sporting a valuation which is almost 50% lower than that of the U.S. equity average / S&P 500.

Fund Filings – Chart by author

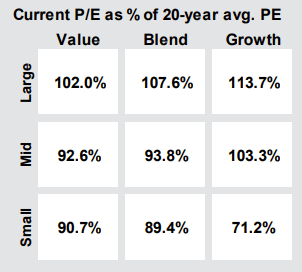

Small-cap value stocks always trade with competitive valuations relative to their peers. Right now, small-cap value stocks are also trading with competitive valuations relative to their historical average. As per J.P. Morgan, small-cap value valuations are currently 10% below their historical average, a relatively large gap, and higher than that of most equity subsegments.

J.P. Morgan Guide to the Markets

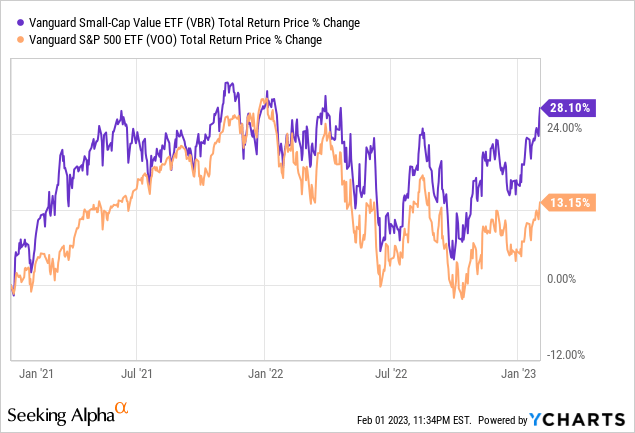

Small-cap value stocks have traded with significantly below-average valuations since early 2020, as the pandemic led to lower share prices for most old-economy industries, due to decreased revenues, earnings, and cash-flows, as well as bearish investor sentiment. Economic conditions have markedly improved since, leading to improved fundamentals, investor sentiment, and outperformance for these stocks, with VBR outperforming since early 2021.

Small-cap value stocks have outperformed for around two years, but valuations remain depressed, so further outperformance is still possible.

In my opinion, outperformance is set to continue, as economic conditions are starting to normalize, with inflation (finally) starting to come down, and investor sentiment much improved since earlier in the year. On a more negative note, possible outperformance is almost entirely dependent on investor sentiment (no catalysts or dividends here), so outperformance is anything but certain.

VBR’s cheap valuation could lead to strong, market-beating capital gains and returns in the coming months, a significant benefit for the fund and its shareholders.

VBR – Performance Analysis

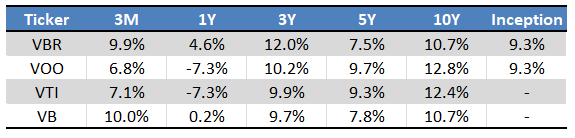

VBR’s performance track-record is slightly below-average. The fund has matched the performance of the S&P 500 since inception, and slightly underperformed these past ten years. Performance has materially improved these past twelve months, as small-cap value valuations have started to normalize. VBR’s performance is as follows.

SeekingAlpha – Chart by Author

In general terms, and from what I’ve seen, VBR’s relative performance is driven by two key factors.

First, the relative performance of the financials, industrials, and tech industry, due to the fund’s aforementioned industry exposures.

Second, changes in small-cap value / U.S. equity valuations, which tend to fluctuate with economic conditions and market sentiment.

VBR has very slightly underperformed relative to the S&P 500 since inception, but most of that underperformance was due to changes in valuations. Remember, small-cap value stocks are 10% undervalued relative to their historical averages, but the same is not true for most equity sub-segments / the S&P 500. Underperformance due to cheapening valuations is, well, not ideal, but not reflective of underlying fundamental weakness, or an indication of future underperformance.

In my opinion, although VBR’s below-average performance track-record is something of a negative, it is an incredibly minor one, and does not outweigh the fund’s cheap valuation.

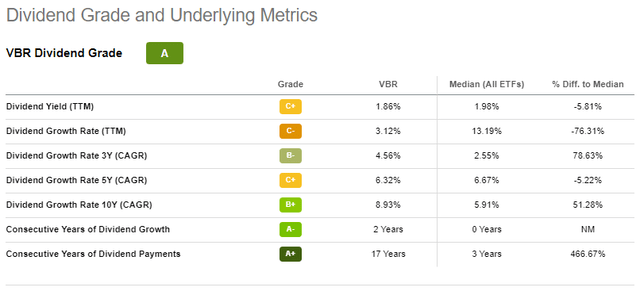

VBR – Quick Dividend Analysis

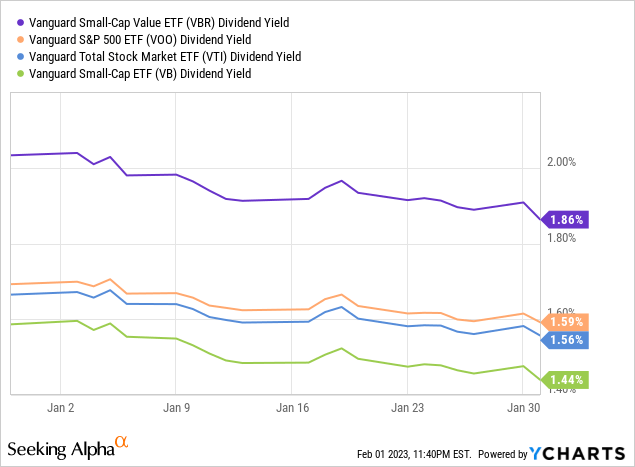

VBR offers investors a meager 1.9% dividend yield. Although it is somewhat higher than average, it is quite low on an absolute basis, making the fund an ineffective income vehicle.

VBR’s dividends tend to see consistent, strong growth year after year, with a 8.9% dividend CAGR for the past decade. Although growth is strong, the starting base / yield is low enough that the fund remains an ineffective income vehicle.

SeekingAlpha

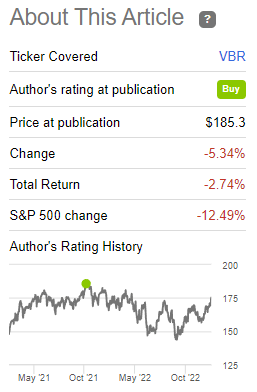

VBR – Looking Back

Finally, a quick update on my previous article on VBR, written in late 2021.

In that article, I argued that VBR’s cheap valuation could lead to market-beating returns in the coming years, and made the fund a buy. Since then, VBR has outperformed relative to the S&P 500, more or less as expected.

VBR Previous Article

Outperformance was entirely driven by valuation gaps narrowing, as per J.P. Morgan data, and my own calculations.

Economic conditions have materially worsened since, making VBR a slightly worse investment. Investor sentiment has somewhat improved, at least concerning small-caps relative to large-caps, making the fund a slightly stronger investment. Net effect from these changes is more or less zero, in my opinion at least. VBR remains an incredibly cheap fund, and so the fund remains a buy.

Conclusion – Buy

The Vanguard Small-Cap Value ETF is a simple, cheap, strong, U.S. small-cap value index ETF. VBR’s cheap valuation and recent outperformance make the fund a buy.