ah_fotobox

(Note: All amounts in the article are in EUR. At the current exchange rate, 1 EUR is around 1.05 USD.)

Investment Thesis

In line with the German real estate sector, Vonovia (OTCPK:VONOY) (OTCPK:VNNVF) has seen a significant share price depreciation since last year.

Vonovia share price (Source: Seeking Alpha)

I have been buying up German real estate companies since early summer, which was a contrarian move. I am a big believer in this approach. When everybody seems to think everything is bad and can only get worse, it is – not always, but very often – a good time to start buying. I was also following the discussion on Seeking Alpha on German real estate stocks and found the arguments of the bulls much more convincing. However, I am grateful for the bearish articles because they gave a balanced view.

I started investing in almost every publicly listed German real estate company of a reasonable size which was not too dependent on new real estate development. I now think it is time to look at companies with significant exposure to new real estate development, too. I thought it was still too early a few months back, and it seems this was the right call.

I ended up with a large position in Vonovia, Grand City Properties (OTCPK:GRNNF), and Aroundtown (AANFF). I did not intend to have a large position in Aroundtown. The company has significant exposure to commercial real estate and is the largest shareholder of Grand City Properties. As I own Grand City Properties too, it creates a cluster risk, and I generally see commercial real estate at the moment as riskier than rental real estate. However, the stock has gone up more than 90% since I started buying, so my Aroundtown position is now sizeable, too.

I have a smaller position in LEG Immobilien (OTCPK:LEGIF) and did own TAG Immobilien (OTCPK:TAGOF), but I have already sold those shares. My position was small, and TAG Immobilien went up too quickly over a short period, so I did not buy more. I usually build up positions over several weeks or months, and sometimes longer, if the investment thesis does not play out as I think it should, but I am still convinced it is correct.

In total, this investment in German real estate companies is among the best ones I ever made, and additionally, it played out in a very short timeframe. While I went in with conviction in the beginning, I admit it was not with a lot of research. It is now time to evaluate what the next steps are.

Conventional analysts are not much help here – in my view. When I started buying there were Sell ratings with the target prices 10-30% above the share price. JP Morgan issued a Sell rating for Vonovia at the end of March with a target price of 18 euros. The share price was around 15 euros at the time. It is not much better now. Recently, Baader Bank (a German broker and investment bank) repeated its Buy rating for Aroundtown with a target price of 1.15 euros. The last time Aroundtown traded at or below 1.15 euros was in July, and it is already over 2 euros now. So, there is a lot of confusion around German real estate companies, at least among analysts.

I did a deeper dive into Vonovia as this is my largest position, and I now think that I will be holding on to the stock for maybe one or two more years. Once the interest rates environment turns, Vonovia should benefit from significant macroeconomic tailwinds. I expect the share price to go back to 30 to 40 euros (where it was just a year ago), a further upside of 40-80%.

Macroeconomic tailwinds

Supply/Demand imbalance in the German rental market

Vonovia owns 550,000 rental apartments. Almost 90% of them are in Germany, around 40,000 in Sweden, and 21,000 in Austria.

Housing construction in Germany is doing miserably. There is already a significant supply/demand imbalance, and it looks like it will get worse. According to the German Statistisches Bundesamt (Federal Statistical Office) Destatis almost 28% fewer building applications for apartments were issued between January and July this year than in the same period last year. For single-family homes the numbers are even worse: building applications for single-family homes were down 36.5% YoY.

The reasons for the lack of new housing construction are obvious: increased financing costs due to interest rate developments and high construction costs because of inflation.

The official goal of the German government is to create 400,000 new housing units every year, to cope with the demographic development. This is not even that ambitious. Since 1950, when the German Federal Republic was founded, on average 405,000 new units were created every year. In 1995, 602,800 new units were built, but in 2022, only 295,300. It looks like 2023 and 2024 are going to be even lower.

Vonovia benefits disproportionally here. Firstly, the German population is growing because of immigration. Secondly, growth mostly happens in urban areas where Vonovia’s apartment portfolio is concentrated. The top 7 large urban areas (Berlin, Hamburg, Munich, Cologne, Frankfurt am Main, Stuttgart, and Düsseldorf) account for more than half of the portfolio in Germany.

The situation is so desperate that the local government of Berlin appointed a Commission on the “Expropriation of Large Housing Companies”, in response to a public referendum in September 2021. It came back with the conclusion that this would be legally feasible, although owners would need to be compensated. The prevailing opinion is that this has a next to zero probability of being executed, even if the legal opinion would turn out to be correct. This is not assured either. In 2019, the City of Berlin introduced a rigorous rent control law (called Mietendeckel), which was struck down by the German Federal Constitutional Court.

Accordingly, Vonovia’s vacancy rate in Germany is at a very low 1.9% (it is 2.2% including the units in Sweden and Austria). The company has stopped all new construction projects planned for 2023 due to rising construction costs and interest rates. Recently the CEO Rolf Buch said that this could continue into 2024.

Compared to other countries Germany is a nation of renters — fewer than half of Germans own their own homes. Accordingly, tenant protections are strong. However, I find it hard to imagine a situation where the largest provider of rental apartments in Germany is not going to benefit from this supply/demand imbalance in the long run. There does not seem to be a quick fix.

I do not think this is reflected adequately in the share price yet. The EPRA NTA (net tangible asset value) per share was 49.67 euros at the end of H1, compared to a current share price of around 22 euros.

Further rent increases

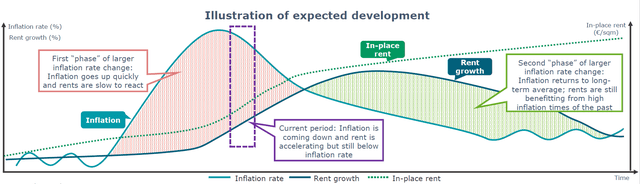

A related topic is rent growth. Inflation and rent growth are strongly correlated but with a time lag. Vonovia’s most recent investor presentation includes the following graph to illustrate the point.

Correlation between inflation and rent growth (Source: Vonovia)

When inflation accelerates, rent growth initially lags because implementation is delayed by factors like regulatory constraints. However, rents are expected to grow faster and for longer once the inflationary pressure has subsided.

In H1 2023 the 12M rolling organic rent increase was +3.5%, compared to +3.4% in H1 2022 (however, the rental EBITDA grew by 7.8% YoY due to reduced expenses and maintenance costs). According to management, it should reach between 3.6% and 3.9% by the end of the year.

While accelerating, rental growth is still below inflation – for now, and it looks like this could change sooner rather than later. In September 2023, inflation in Germany slowed to 4.5%, significantly down from August when it was still 6.1%.

Balance sheet, debt maturities, and liquidity

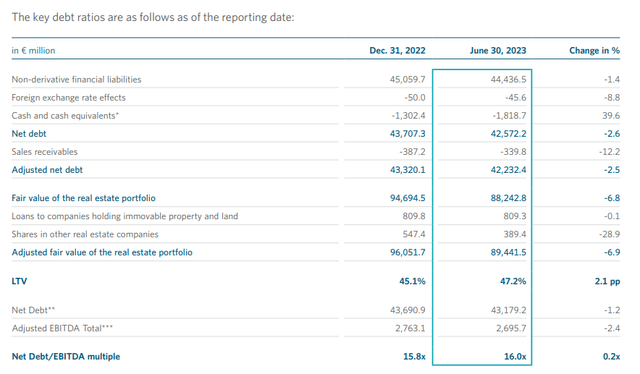

Vonovia has three core debt KPIs:

- LTV (loan to value) between 40-45%

- Net debt / EBITDA within a range of 14-15x

- ICR (interest coverage rate) of at least 3.5x

Due to the write-downs in Q1 and Q2, the LTV is now 47.2% and Net Debt/EBITDA multiple is at 16. The only KPI above the target is the ICR, which was 4.7.

So, Vonovia is breaching two out of the three KPIs.

Vonovia debt KPIs (Source: Vonovia)

While this is not great, I would argue that Vonovia has managed the downturn reasonably well so far.

The company has enough liquidity, and all debt maturities are covered until the end of 2024. But It will need to refinance (or pay back) around 4-5bn euros of debt every year between 2025 and 2030. An investment grade credit rating and a revolving credit facility of 3bn euros (which was extended until 2026 in Q2) should help, but I assume that further disposals are necessary. In its H1 results presentation, Vonovia says it is working on a JV in Northern Germany with a fair value similar to the sold Südewo portfolio – so around 1bn.

Dividend

Vonovia usually pays out 70% of Group FFO as a dividend. As is common for German and European companies, this is once per year. To preserve liquidity, the payout was halved this year, but the dividend yield was still around 5% at the payout time in June.

Most other German real estate companies skipped their dividend this year, so Vonovia stands out. The cash out was further reduced to around 373mn euros as the company has a scrip dividend program in place, and 45% of shareholders took advantage of that. For reference – the total FFO was 1,944mn in 2022 and 948.6mn so far in H1 2023 (-9.5% YoY).

As Vonovia has breached two of its debt KPIs this year due to the write-downs, a dividend payout next year is not assured, even though there would be ample room for one given the expected FFO. However, management is still guiding for a 70% payout. The expected FFO per share for the full year is 2.15-2.39 euros. So, the dividend yield would be between 6.8% and 7.6%, based on a share price of 22 euros.

Even if a dividend payout does not happen, investors should keep the scrip dividend in mind. It is a nice way to avoid the German dividend withholding tax. The process is bureaucratic for retail investors, and from my own experience, I know it can take up to two years. For that to work, investors should not buy the ADR shares.

Valuation

As earnings were negative in H1 2023 due to the write-down, it is better to look at funds from operations to see how the valuation looks compared to the operational performance. FFO per share was 19.14 in H1 2023, so around 9.5 on an annualized basis. This is not expensive, and significantly below the historic average of around 20 over the last 5 years from 2018 to 2022.

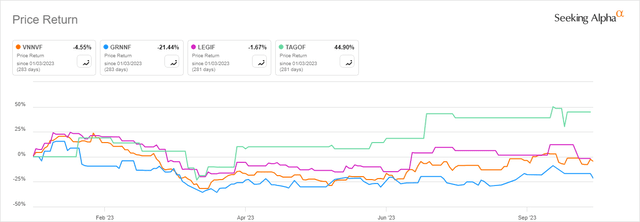

But it is in line with other German rental real estate companies. LEG Immobilien comes to 20.36 (based on the H1 FFO), and TAG Immobilien to 19.64. Only Grand City Properties is lower with 15.71.

The companies are also comparable regarding their NTA values per share compared to the share price, while all have a low number. Vonovia is at 0.45, LEG Immobilien at 0.46, TAG Immobilien a little higher at 0.53 and Grand City Properties again lower at 0.34.

The difference in valuation is because Grand City Properties has appreciated much less YTD than the other three.

Price/Return comparison (Source: Seeking Alpha)

My takeaway here is that Vonovia’s valuation will probably only improve in line with the real estate sector and real estate prices. Once the macroeconomic environment for the sector improves, I think shares will go back to a range between 30-40 euros. So I intend to hold at least until shares reach 30 euros, and I realize that this could take at least one to two years.

I own both Vonovia and Grand City Properties, but my position in Vonovia is larger. This is because of the difference in company size and the resulting difference in risk. Vonovia is part of the German DAX index and has a market cap of 18.39bn euros, Grand City Properties is much smaller with just 1.75bn.

Risks to the investment thesis

The biggest risk is the interest rate environment. If interest rates stay higher for longer, the investment thesis is still correct, in my view. As I consider the long-term macroeconomic environment favorable for Vonovia, it will just take longer to play out.

A further need to write down the value of its assets is another risk. This would be bad for the share price, but Vonovia also has an additional covenant risk on its debt.

The need for further write-downs could arise if prices go down more, but it is also possible that there is already a mismatch between what Vonovia thinks its assets are worth currently and what the real market prices are.

This does not seem to be the case though. Vonovia has written down the value of its real estate portfolio by around 11% since the peak in June 2022. This looks to be at least in line with where market prices went. According to the numbers from Destatis, which are based on actual market transactions for new and existing buildings, prices have declined by an average of 9.9% in that period. There are regional differences, so Destatis segments the numbers into five categories, from rural to larger cities (where Vonovia has most of its apartments). In the top 7 large urban areas (Berlin, Hamburg, Munich, Cologne, Frankfurt am Main, Stuttgart, and Düsseldorf) prices for apartments fell by 9.8% in Q2 2023 compared to the same quarter of the previous year. Therefore, I think the depreciation Vonovia applied to its portfolio is adequate and gives maybe even some cushion.

That does not mean prices cannot go down further. However, the downturn in Q2 2023 was already significantly weaker when compared quarterly: compared to the first quarter of 2023, residential properties were 1.5% cheaper; in the two previous quarters the QoQ decline was significantly higher at 2.9 and 5.1%, respectively.

In the Capital Markets presentation from September 28 (so quite recently) Vonovia says it is too early to give an H2 valuation guidance, but notes that based on the Q2 valuation there is a 25% headroom for compliance with bond covenants (not considering any positive impact from further rent growth and disposals).

My takeaway here is twofold. First, prices can go down further in the short term, but probably not significantly. Second, it would take a very drastic macroeconomic shock for prices to go down a further 25% and for Vonovia to breach its debt covenants.

Longer term, the dynamics of supply and demand point to rising prices, and rising rents.

Conclusion

Once the interest rate environment turns, Vonovia should benefit from significant macroeconomic tailwinds. This could not happen in 2023, but I assume sometime in 2024.

We have seen the share price above 50 euros in the past. However, I do not think we will get there anytime soon again. Those prices were driven by basically free money and those days are over for now. However, I expect that over the next two years, the share price could go back to 30 to 40 euros where it was just a year ago, an upside of 40-80% from where the shares are now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.