DNY59/E+ via Getty Images

If you take a bath on a stock, you should let everyone know about it. The humbling experience and lessons that come with that are part of the investing experience. Today we share 3 key lessons from the W. P. Carey Inc. (WPC) debacle that will hopefully help everyone make better decisions.

What Happened?

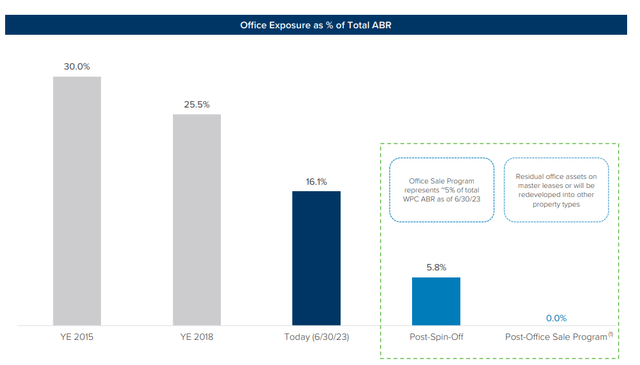

While the situation has been covered in quite a few articles, we want to do a brief recap here and give our view of what WPC did. WPC announced a plan to spin-off its a large part of its office assets and sell the remaining shortly thereafter. In other words, accelerate the pathway to zero office assets, something that they were doing anyway.

WPC Presentation

This will necessitate a dividend cut according to WPC as it will be targeting 70-75% AFFO payout ratio on the new company. Our baseline here for the stand alone company is close to $4.75 in AFFO and that would mean that the dividend could be as low as $3.30, down from $4.28 currently.

Lesson One: Diversify

As good as WPC looked and it did start to look incredibly good as it dipped below $70, you have to remember to diversify. No company, no matter how terrific and perfectly valued, deserves a diversification rule-break. In this particular case, the forward equity sales which WPC did has part of the spin-off, likely had the banks hedging by shorting the stock. So the stock was dropping faster and underperforming the REIT sector, while fundamentals appeared to be unchanged. That would make it tempting to go “all-in”. But the underperformance was obviously warranted as the fact that WPC was ready to unload a large amount of equity meant that management themselves had little confidence in the outlook for the stock, regardless of what line they read on the conference call. So let’s always keep our positions under control and never get too excited when something goes on “sale”.

Lesson Two: Choose Good Entry Points

As much as we would like to blame management for a rather bad decision, investors who chased WPC into the high $80s only have themselves to blame. In essence at $85 a share, you paid a ZIRP (zero interest rate policy) multiple (highlighted in yellow), even though it was clear that the era had ended.

TIKR

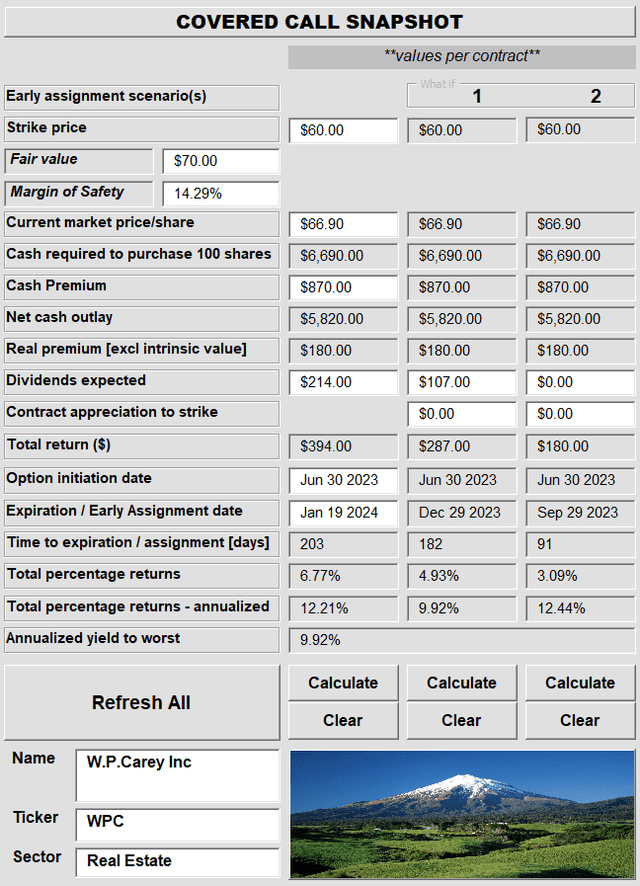

Even during ZIRP, WPC traded as low as 12X forward funds from operations (FFO), on 4 separate occasions. So chasing it at 17X-18Xmultiples meant that you had at least a high probability of a 30% drawdown. Our own experience was also colored with red here, despite using more than a modicum of caution. We almost never buy anything outright and we used $60 strike covered calls and some $55 calls as well. Below we show the more damaged $60 call trade.

Author’s App

The stock has actually gone even below our net cash outlay of $58.20. At least we won’t have to deal with early assignment. We have that going for us, which is nice.

Lesson Three: Don’t Go Gaga On A Sector

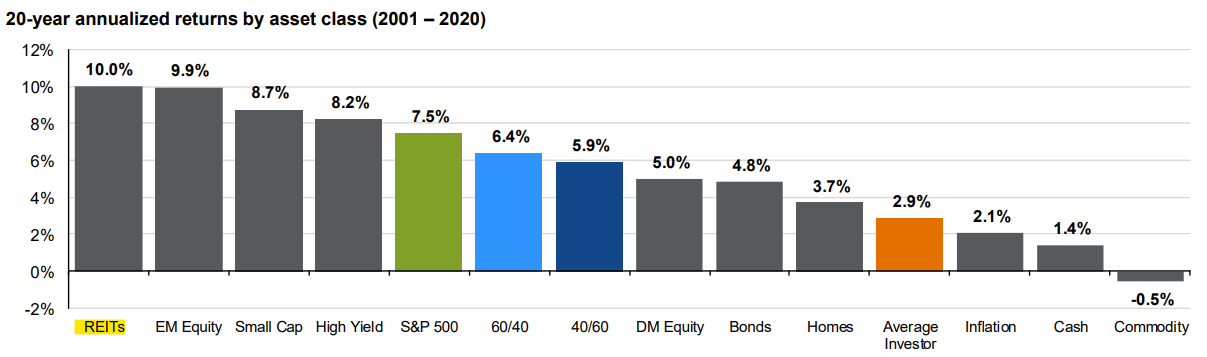

REIT sector investors tend to be the most guilty of this error. It is not unusual to see retail investors have 30-75% of their holdings here. Some even go 100% in, lured by slides like these.

JP Morgan

That slide also explains why the average investor does so poorly. It is because they go into an asset class with maximum recency bias and forget that the next 20 years will look very different than the last 20. If you hold an abnormal percentage of your assets in one sector, it will likely interfere with your decision making. Keep in mind that the S&P 500 has only 2.4% in REITs, so while it is fine to overweight, you should consider how much you will be impacted if REITs turn out to be the worst sector for the next 10 years.

What To Do With WPC

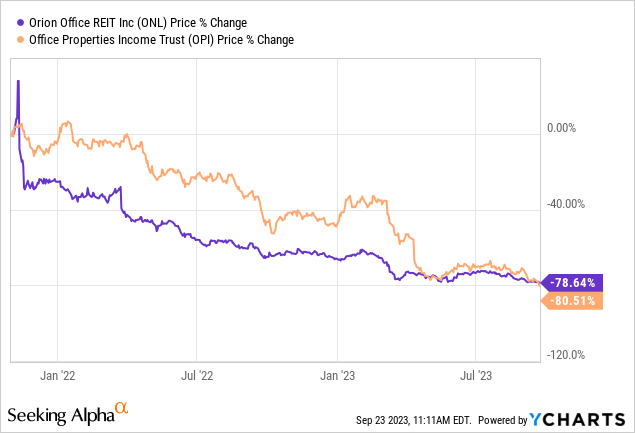

We saw WPC has modestly undervalued prior to the spin-off decision. The spin-off itself is likely to be received very poorly. Single office property REITs like Office Properties Income Trust Inc. (OPI) and Orion Office REIT Inc. (ONL) have been struggling to put it mildly. The ONL puppy was spun-off from the “big-dawg”, Realty Income (O), with the a great deal of fanfare as investors felt they were getting a bargain at 8X FFO.

So you should be ecstatic if you get a 6X FFO multiple when it lists. We view this spin-off as a terrible decision.

The best option was for WPC to slowly sell office assets over a period of even 7-10 years. On the conference call they mentioned the cap rates they were getting for these.

RJ Milligan

Hey, guys. A couple of follow-ups. So it looks like the proceeds from the Office Sale Program sort of implies an 8.3% cap rate. Is that in the right range?

Jason Fox

Brooks, any comment on that?

Brooks Gordon

Sure. I think that’s directionally right. I think it depends on the specific execution of each deal, but we do expect kind of high single-digits blended average cap rate for the Office Sale Program.

Source: WPC Transcript

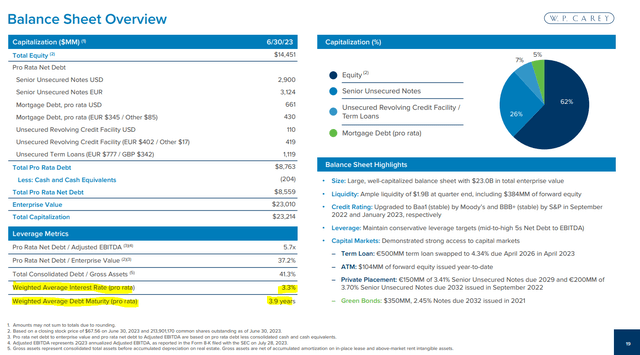

If we assume that the non-office portfolio grows at about 2% a year and office was sold at 8.5% cap rates over the next 7 years, we can get a feel for how this would go. We also have to factor in rising interest rates on debt. WPC has one of the shortest debt maturity profiles amongst the triple-nets and that would likely increase interest expense by 50% over the next 5-7 years if interest rates stay here.

WPC Presentation

Combining this information it appears to us that WPC would likely be able to have a flattish FFO profile over the next 7 years. One big factor preventing FFO from dropping would be the approximate $200 million of FFO retained post dividends that could be used to pay off maturing debt.

We cannot envision any scenario where the FFO would drop below $5.00 on the whole company. So the dividend did not have to be made into a sacrificial lamb.

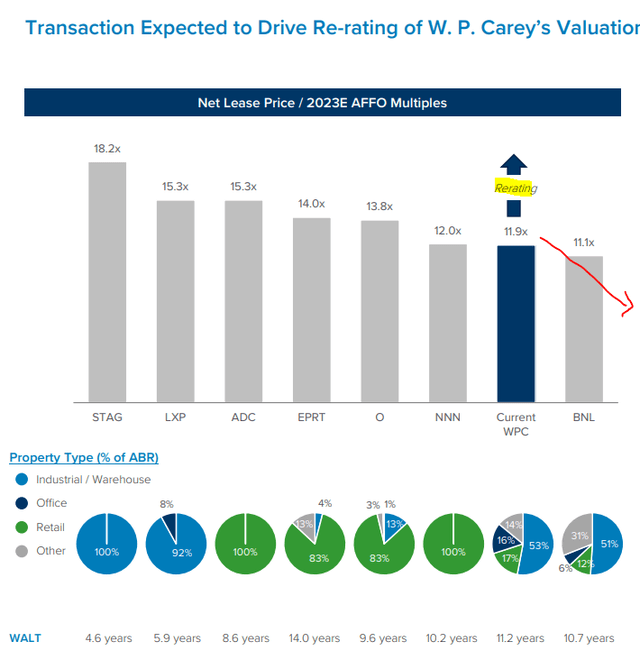

We are sure management could see this as well and instead chose to go down that silly path which every management team deems it necessary to. Chasing growth. By throwing out those assets they can claim a nice reset point and spin it as something good for the company. But no-one in their right mind is going to give them this rerating (at least in the direction they are aiming) after blowing up their primary investor class.

WPC Presentation

WPC will likely trade between $55-$60 in the near future. We are lowering our fair value here to $55 as WPC has destroyed shareholder value by this transaction. We would use a bounce to sell calls on positions if you don’t already have them in place. For existing calls, a roll out further will improve your net cost basis and reduce your risks further. One caveat here is that all options will become “Special” post the spin-off and liquidity will fall off the cliff. But we still think adjusting the risk profile via call selling is preferable into any bounce.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.