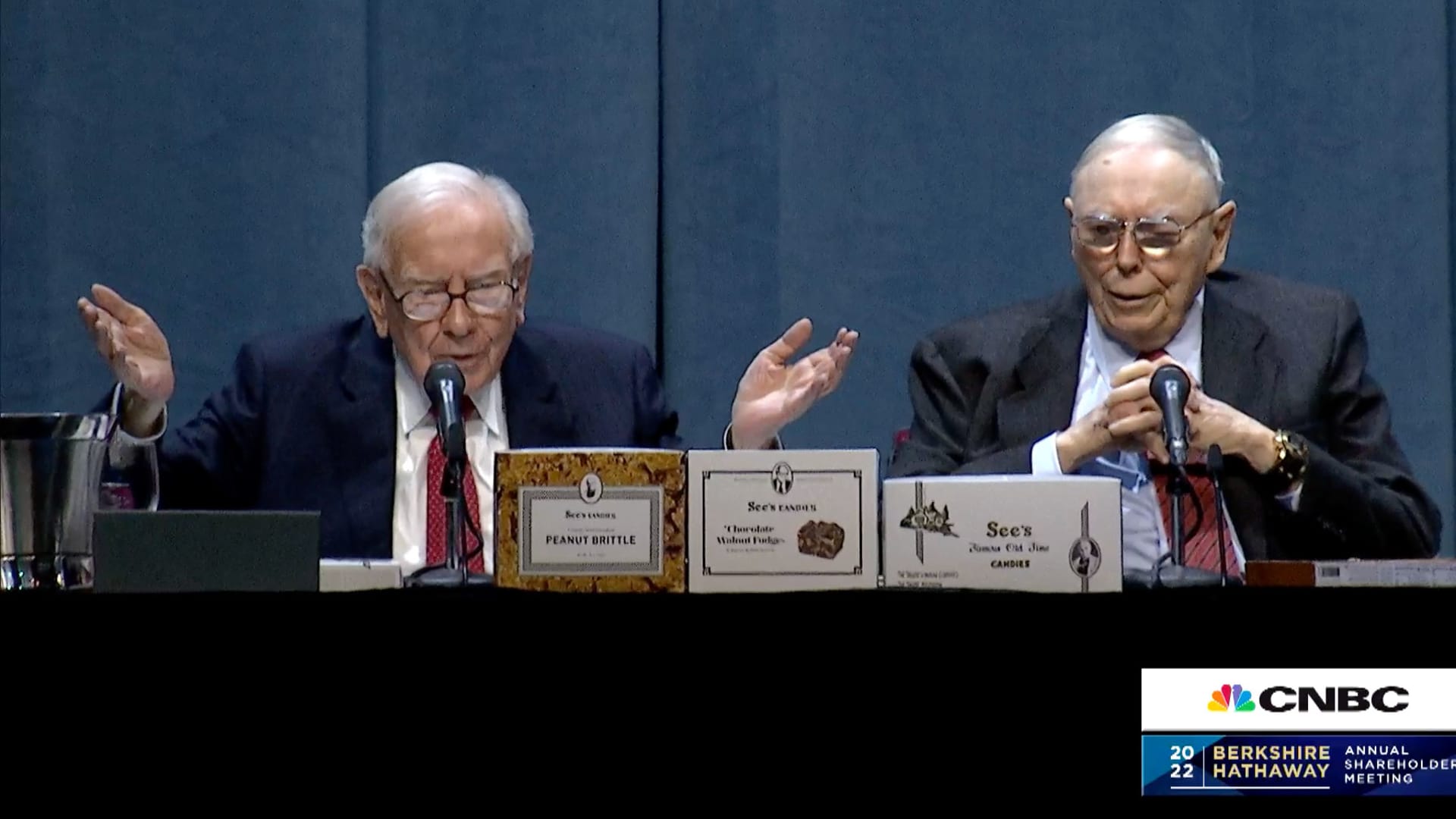

Bitcoin has steadily been gaining acceptance from the standard finance and funding world lately however Warren Buffett is sticking to his skeptical stance on bitcoin.

He stated on the Berkshire Hathaway Annual Shareholder assembly Saturday that it isn’t a productive asset and it does not produce something tangible. Regardless of a shift in public notion concerning the cryptocurrency, Buffett nonetheless would not purchase it.

“Whether or not it goes up or down within the subsequent yr, or 5 or 10 years, I do not know. However the one factor I am fairly positive of is that it does not produce something,” Buffett stated. “It is received a magic to it and other people have connected magics to a number of issues.”

Even bitcoin lovers have a tendency to treat the cryptocurrency as a passive asset that buyers purchase and maintain and hope to see improve in value over an extended interval. Buffet himself commented that there is “no one” that is brief on bitcoin, everyone seems to be a long-term holder.

For extra subtle crypto buyers, some cash provide a approach for them to make use of their crypto productively — both by lending, or as collateral — to create further portfolio advantages. Nevertheless, they’re nonetheless younger, extremely speculative and have not damaged into the mainstream like bitcoin.

Buffett elaborated on why he does not see worth in bitcoin, evaluating it to issues that generate different varieties of worth.

“When you stated… for a 1% curiosity in all of the farmland in the US, pay our group $25 billion, I am going to write you a examine this afternoon,” Buffett stated. “[For] $25 billion I now personal 1% of the farmland. [If] you provide me 1% of all of the house homes within the nation and also you need one other $25 billion, I am going to write you a examine, it is quite simple. Now in the event you instructed me you personal the entire bitcoin on this planet and also you supplied it to me for $25 I would not take it as a result of what would I do with it? I would need to promote it again to you a technique or one other. It is not going to do something. The flats are going to supply lease and the farms are going to supply meals.”

Buyers for years have been puzzled over how you can worth bitcoin partly due to its potential to serve completely different features. In Western markets it has been established as an funding asset, notably previously yr as charges and inflation have been on the rise. In different markets, folks nonetheless see monumental potential for its use as digital money.

“Property, to have worth, need to ship one thing to any person. And there is just one forex that is accepted. You possibly can give you every kind of issues — we will put up Berkshire cash… however in the long run, that is cash,” he stated, holding up a $20 invoice. “And there isn’t any cause on this planet why the US authorities… goes to let Berkshire cash substitute theirs.”

Each Buffett and Charlie Munger have made hostile feedback towards bitcoin previously. Most famously, Buffett stated bitcoin is “most likely rat poison squared.” Munger doubled down on that sentiment Saturday.

“In my life, I try to keep away from issues which can be silly and evil and make me look dangerous compared to any person else – and bitcoin does all three,” Munger stated. “Within the first place, it is silly as a result of it is nonetheless more likely to go to zero. It is evil as a result of it undermines the Federal Reserve System… and third, it makes us look silly in comparison with the Communist chief in China. He was good sufficient to ban bitcoin in China.”