You’re leaving on the table if you continue to stake with Exchanges.

When it comes to Proof of Stake (PoS) chains, people often talk about passive income earned by staking their coins. More often than not, participation is done through a process called ‘delegation’.

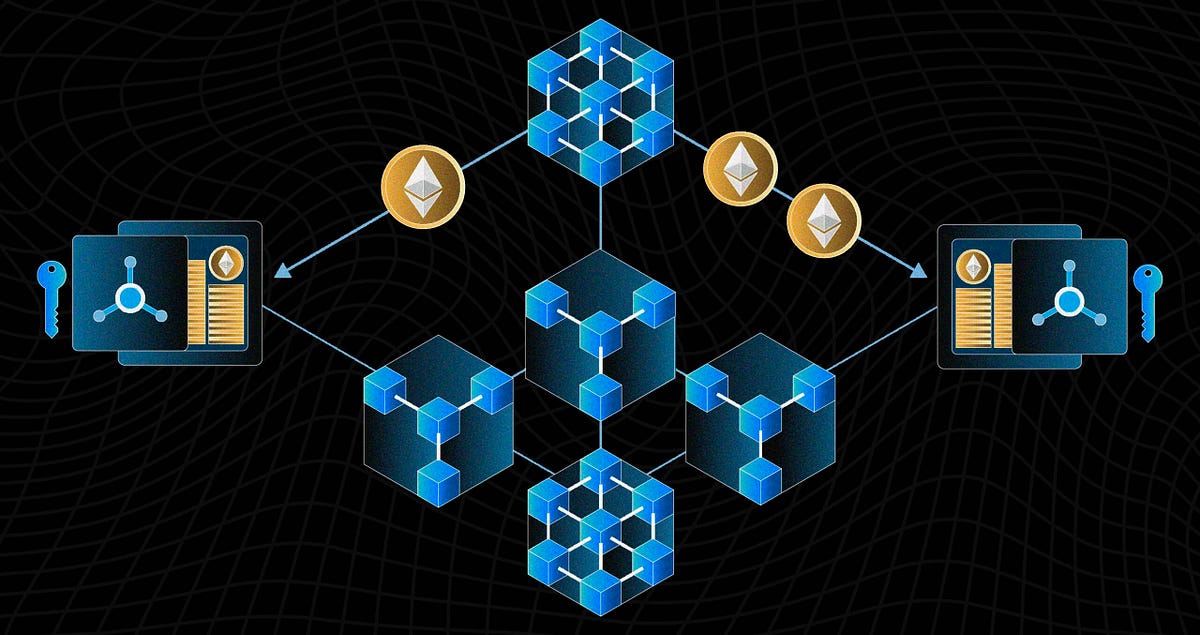

For the unfamiliar, delegation is simply: “I will give control of my tokens to you for X amount of time, you can handle the technical stuff — on the condition that you give me a cut of the earnings.” As luck would have it, many US-based exchanges have made offering passive staking one of their biggest income generators.

Blinded by the promise of near-term ROI — we often neglect to think about the future-state of the chain; namely its decentralization (and the other health factors of a public chain that are related to this figure). One risk to almost any public blockchain (that truly aims for decentralization, like Ethereum) is the potential for centralization of nodes under a single entity. If a malicious group were to gain a supermajority of nodes, they could dictate not only the future of the chain, but also change the past. For obvious reasons, this is to be avoided at all costs.

If that wasn’t reason enough to be leery of exchange staking, they also frequently take a significant portion of your token’t hard-earned yield to boot. All that revenue has to come from somewhere, after all. Exchange staking may be a good place to start (I started there as well) — but in the long run, in more ways than one, it is in your best interest to stake wisely.

Imagine NodeCorp, a company specializing in web3 custodial staking as a service (SaaS v2?) who, if their nodes being N, and all nodes being A:

N > A/2

NodeCorp would hold a majority of the network’s nodes, potentially putting the entire chain at risk.

Public blockchains are all about decentralization — not only in number of nodes, but also in the number of parties running the nodes. In a perfectly decentralized peer-to-peer (P2P) network, the number of parties running nodes would be equal to the number of nodes in existence. This would ensure that no single party could ever take a majority of the validation efforts.

Put more simply: if there were 100 nodes in a ‘perfectly decentralized’ network, 100 disconnected parties would run node each, never knowing who the other 99 participants were.

We know that the 100% decentralized scenario would never happen — with products like exchange staking from Coinbase / Kraken etc., it’s simply too convenient to delegate to someone who is much better at it (the exchanges). Pair this with the fact that running a full validation node requires an above-average amount of technical know-how, and we can pretty safely assume that most will only ever opt to stake with exchanges.

Exchange staking aside, with these things in mind, the question shifts to something like “well, then I suppose we should be careful who we delegate to, right?” That is the essence of this article.

Now that you’ve decided you’re taking the conscious path and not staking on an exchange, it’s time to shop around for some validators that you can stake with. Tools like Crypto BZH are extremely useful for looking at key metrics of the validators that you may be considering using!

Key metrics to check:

- Commission — A validator that charges a high commission (cough, exchanges, cough) are not doing anything differently than validators that charge low commissions, so you might as well stake where you can keep a more reasonable amount of your money in your own pocket.

- Missed Blocks — A validator that misses a high percentage of blocks most likely has a configuration issue, and you’ll want to steer clear of it. After all, if the validator you’re delegating to can’t keep it online and up, it will never be selected to validate, and (perhaps what you care about most) you’ll never get your rewards!

- Self-Delegation — As the name describes, how much of the pool is the Validator’s own money? If this figure is suspiciously low, you may want to exercise caution before selecting this validator. Without any skin in the game, how can you be sure that they will behave in you and the other delegators’ best interests?

- Max Commission — This is a figure that only matters if you’re planning for a real ‘set and forget’ approach, but max commission refers to the max percentage a validator will ever be able to charge a set pool. If commission is 0% today, but you can see that they have the choice to crank the percentage to 100%, it may be too good to be true. Unless you plan to check back somewhat frequently, perhaps you should select a validator with ~10% max commission.

- Min Self-Delegation — This figure is similar to #4, in that it only matters in the long-term. This number refers to the amount of their own tokens that the validator are required to keep within the pool. Inverse of Max Commission, if this figure is 0%, meaning they don’t have to keep any of their tokens in the pool long-term, exercise caution.

I hope this post helped to highlight the fact that your participation in web3 staking has far more impact than you might’ve previously expected, and how much money you might be leaving on the table if you continue to stake with Exchanges.

When you’re moving your funds off of exchanges in your endless quest to become a more mindful participant in web3, look back to this article for a refresher!

Stake Responsibly, My Friends