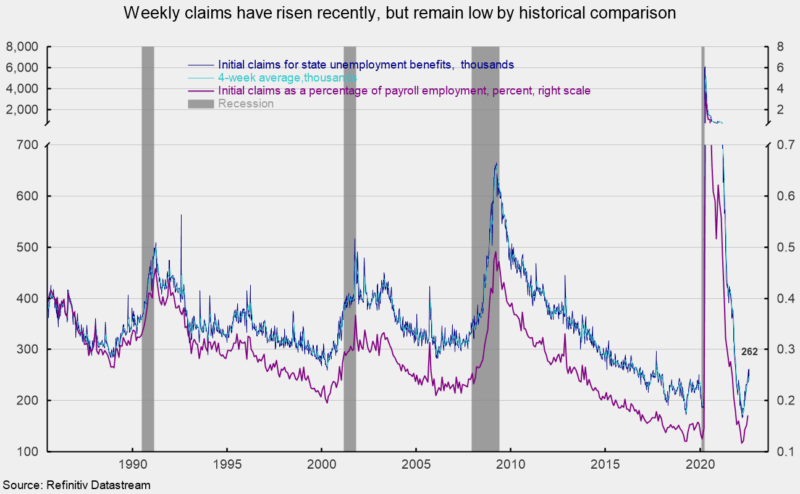

Preliminary claims for normal state unemployment insurance coverage rose 14,000 for the week ending August sixth, coming in at 262,000. The earlier week’s 248,000 was revised down from the preliminary tally of 260,000 (see first chart). When measured as a proportion of nonfarm payrolls, claims got here in at 0.171 % for the month of July, up from 0.152 in June and a file low of 0.117 in March, however nonetheless very low (see second chart).

The four-week common rose for the seventeenth time within the final eighteen weeks (the four-week common was unchanged in a single week), coming in at 252,000, up 4,500 from the prior week. Weekly preliminary claims information proceed to counsel a decent labor market, although the current sustained upward pattern signifies some easing. Continued elevated charges of worth will increase, an aggressive Fed tightening cycle, and fallout from the Russian invasion of Ukraine signify dangers to the financial outlook.

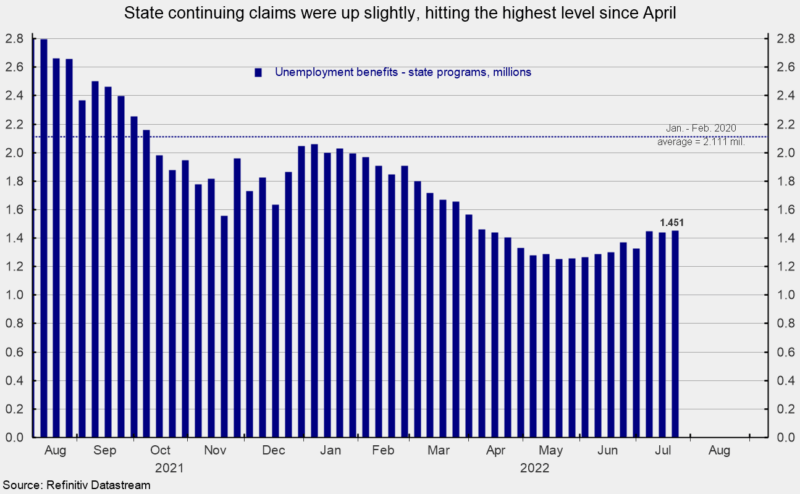

The variety of ongoing claims for state unemployment packages totaled 1.451 million for the week ending July 23rd, an increase of 10,067 from the prior week (see third chart). State persevering with claims are additionally trending greater during the last a number of weeks however stay very low (see third chart).

The most recent outcomes for the mixed Federal and state packages put the entire variety of individuals claiming advantages in all unemployment packages at 1.479 million for the week ended July 23rd, a rise of 9,206 from the prior week. The most recent result’s the twenty-fourth week in a row beneath 2 million.

Preliminary claims stay at a really low stage by historic comparability, however a transparent upward pattern has emerged, suggesting that, on the margin, the labor market has begun to loosen. Weekly preliminary claims for unemployment insurance coverage is an AIER main indicator, and remained a positive contributor within the July replace. Nonetheless, given the upward trajectory, it can doubtless flip to a impartial place in coming updates. Moreover, the variety of open jobs within the nation has receded for 3 consecutive months, although the extent stays very excessive by historic comparability.

Whereas the general low stage of claims mixed with the excessive variety of open jobs suggests the labor market stays strong, each measures are displaying indicators of softening. The tight labor market is an important element of the financial system, offering assist for shopper spending. Nonetheless, persistently elevated charges of worth will increase already weigh on shopper attitudes, and if customers lose confidence within the labor market, they might considerably scale back spending. The outlook stays extremely unsure.