Jacqueline Nix

Earnings of WesBanco, Inc. (NASDAQ:WSBC) will likely dip this year before recovering next year. Growth in both commercial real estate and residential loan segments will likely sustain earnings through the end of 2023. Further, the rising rate environment will lift the margin. On the other hand, higher provision and salary expenses will likely drag earnings. Overall, I’m expecting WesBanco to report earnings of $2.80 per share for 2022, down 21% year-over-year. Compared to my last report on the company, I’ve tweaked upwards my earnings estimate because I’ve revised both my loan growth and provision expense estimates. For 2023, I’m expecting earnings to grow by 8% to $3.02 per share. The year-end target price is quite close to the current market price. Therefore, I’m maintaining a hold rating on WesBanco, Inc.

Loan Growth to Depend on Economic Factors

The loan portfolio finally trended upwards during the second quarter of 2022 after declining every quarter from June 2020 to December 2021 and then remaining almost unchanged for the first quarter of 2022. The positive trend will likely continue in the quarters ahead.

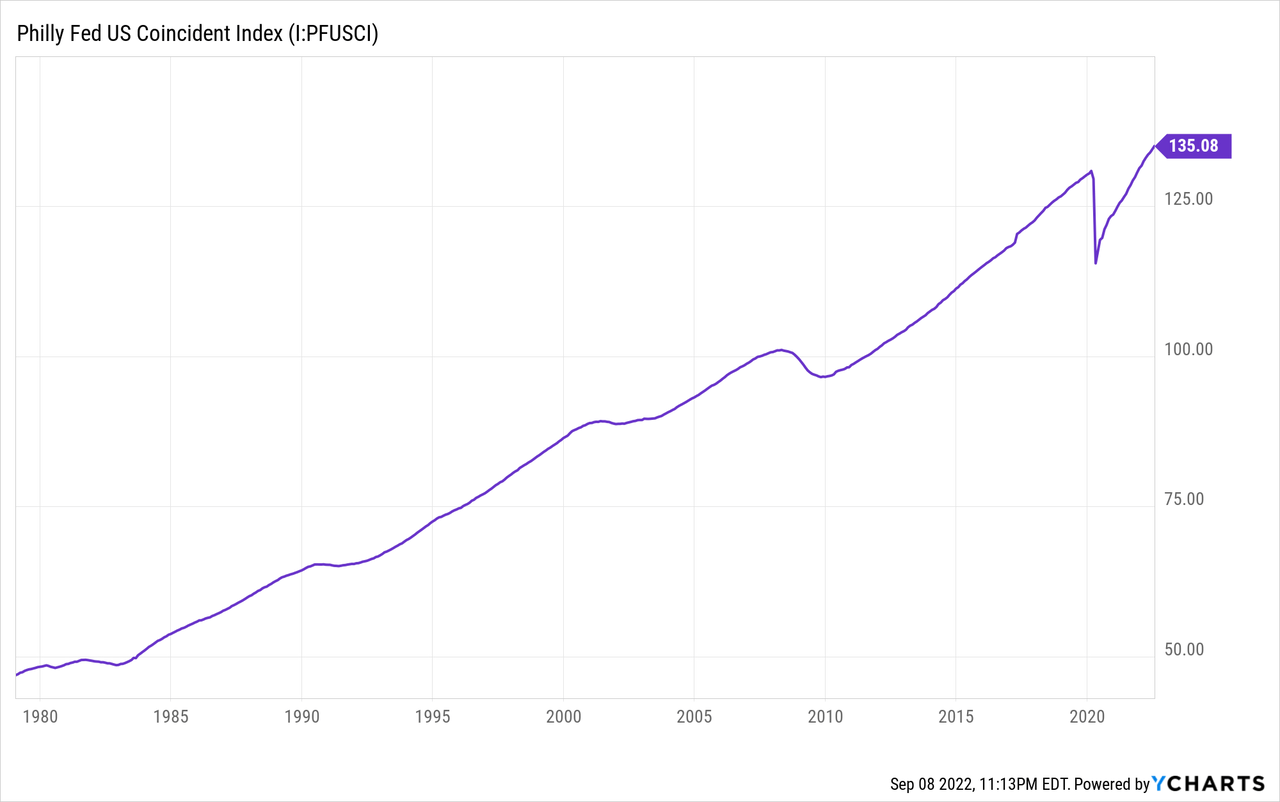

More than half the loan book comprises commercial real estate loans. Further, WesBanco’s loan book is well diversified geographically. Therefore, the U.S. coincident index is an appropriate gauge for the company’s product demand. As shown below, the index indicates that the economy is in satisfactory shape, which bodes well for loan growth.

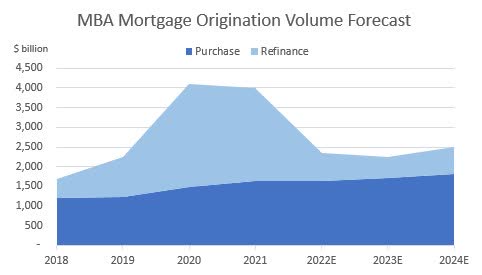

Residential real estate and home equity loans also make up a sizable portion of the portfolio, at around a quarter of total loans. The Mortgage Bankers Association forecasts mortgage purchase volume to remain flattish this year compared to last year and then grow by 4% year-over-year in 2023, which bodes well for WesBanco’s loan growth outlook. Further, MBA expects refinancing volume to plunge this year, which means there is less chance that customers will leave WesBanco in favor of other financial institutions or vice versa.

Mortgage Bankers Association

Considering these factors, I’m expecting the loan portfolio to grow by 6% annualized in the second half of 2022 and 4% in 2023. This leads to full-year 2022 loan growth of 8.2%. In my last report on WesBanco, I estimated a much lower loan growth of 3.1%. I’ve increased my loan growth estimate for the full year only because of the second quarter’s performance. I haven’t changed my estimate for the second half of this year. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||

| Financial Position | ||||||||

| Net Loans | 7,607 | 10,216 | 10,603 | 9,612 | 10,396 | 10,818 | ||

| Growth of Net Loans | 20.8% | 34.3% | 3.8% | (9.4)% | 8.2% | 4.1% | ||

| Other Earning Assets | 3,200 | 3,353 | 3,612 | 5,151 | 4,548 | 4,732 | ||

| Deposits | 8,832 | 11,004 | 12,429 | 13,566 | 13,842 | 14,404 | ||

| Borrowings and Sub-Debt | 1,535 | 1,898 | 983 | 459 | 563 | 565 | ||

| Common equity | 1,979 | 2,594 | 2,612 | 2,549 | 2,370 | 2,468 | ||

| Book Value Per Share ($) | 40.4 | 46.1 | 38.8 | 40.3 | 39.4 | 41.0 | ||

| Tangible BVPS ($) | 21.6 | 25.7 | 21.5 | 22.1 | 20.3 | 22.0 | ||

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

||||||||

Deposit Pricing Power Likely to Dip

The 150 basis points fed funds rate hike during the first half of 2022, and the subsequent 75 basis points rate hike in July should continue to lift the average earning-asset yield in the remainder of the year. Therefore, the net interest margin will likely continue to improve in the second half of the year after already expanding by eight basis points in the second quarter of the year.

Theoretically, the deposit beta (rate sensitivity) should be quite high because the deposit book is heavy on interest-bearing deposits that re-price frequently. These deposits, namely interest-bearing demand, money market, and savings accounts, made up 57% of total deposits at the end of June 2022. However, so far this year WesBanco has demonstrated great pricing power when comes to deposits. The management mentioned in the latest conference call that their deposit beta has been a negative 3% during the first half of the year. Most of the success was attributable to an enforced lag in re-pricing. In my opinion, WesBanco cannot keep deposit rates down for long. Therefore, I’m expecting a high deposit beta in the second half of the year.

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing show that the net interest margin is only moderately sensitive to rate changes. A 200-basis points hike in interest rates could boost the net interest income by 7.2% over twelve months. Further, the management mentioned in the conference call that it expects the margin to improve by five basis points for each 25-basis point hike in the fed funds rate.

Considering the factors given above and the management’s guidance, I’m expecting the margin to grow by 25 basis points in the second half of 2022 before stabilizing in 2023.

Provisioning Likely to Normalize Soon

WesBanco surprised me by continuing to report a net reversal of provisions in the second quarter of 2022. Compared to the last quarter, the economic outlook has worsened because of the greater-than-expected rate hikes. Therefore, WesBanco will likely have to increase its provisions for expected loan losses. On the plus side, around 76% of the loan portfolio is backed by real estate. Therefore, the credit risk is not that high.

Considering these factors, I’m expecting the net provision expense to make up 0.18% (annualized) of total loans every quarter until the end of 2023, which is the same as the average for 2017 to 2019. In my last report on WesBanco, I estimated a net provision expense of $15 million for 2022. I’ve now slashed my net provision expense estimate to $6 million for this year partly because of the second quarter’s surprise. Moreover, my outlook is not as negative as before.

Expecting Earnings to Dip by 21%

The higher provision expense will likely play a key role in reducing earnings this year. Further, the non-interest expense will likely continue to grow due to high inflation which will push up salary expenses. The management mentioned in the conference call that it expects a 6% to 8% growth in non-interest expenses, mostly due to personnel-related costs.

On the other hand, the anticipated loan growth and margin expansion will likely support earnings till the end of 2023. Overall, I’m expecting WesBanco to report earnings of $2.80 per share for 2022, down 21% year-over-year. For 2023, I’m expecting earnings to grow by 8% to $3.02 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||

| Income Statement | ||||||||

| Net interest income | 347 | 400 | 479 | 458 | 463 | 503 | ||

| Provision for loan losses | 8 | 11 | 108 | (64) | 6 | 20 | ||

| Non-interest income | 100 | 117 | 128 | 133 | 122 | 132 | ||

| Non-interest expense | 265 | 312 | 355 | 353 | 358 | 378 | ||

| Net income – Common Sh. | 143 | 159 | 119 | 232 | 170 | 182 | ||

| EPS – Diluted ($) | 2.92 | 2.83 | 1.77 | 3.53 | 2.80 | 3.02 | ||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||

In my last report on WesBanco, I estimated earnings of $2.56 per share for 2022. I’ve increased my earnings estimate mostly because I’ve raised my loan growth estimate and reduced my provision expense estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Current Market Price Close to the Year-End Target Price

WesBanco has a long-standing tradition of increasing its dividend every year. Given the earnings outlook for 2023, I’m expecting the company to increase its dividend again by $0.01 per share early next year. This will lead to a full-year dividend payout of $1.4 per share, which implies a 46% payout ratio. In comparison, the payout ratio averaged 44% from 2017 to 2019. My dividend estimate suggests a forward dividend yield of 4.0%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value WesBanco. The stock has traded at an average P/TB ratio of 1.57 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 21.6 | 25.7 | 21.5 | 22.1 | ||

| Average Market Price ($) | 44.1 | 38.1 | 25.3 | 34.7 | ||

| Historical P/TB | 2.04x | 1.48x | 1.17x | 1.57x | 1.57x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $20.3 gives a target price of $31.8 for the end of 2022. This price target implies an 8.0% downside from the September 8 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.37x | 1.47x | 1.57x | 1.67x | 1.77x |

| TBVPS – Dec 2022 ($) | 20.3 | 20.3 | 20.3 | 20.3 | 20.3 |

| Target Price ($) | 27.8 | 29.8 | 31.8 | 33.9 | 35.9 |

| Market Price ($) | 34.6 | 34.6 | 34.6 | 34.6 | 34.6 |

| Upside/(Downside) | (19.7)% | (13.8)% | (8.0)% | (2.1)% | 3.8% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 13.2x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 2.92 | 2.83 | 1.77 | 3.53 | ||

| Average Market Price ($) | 44.1 | 38.1 | 25.3 | 34.7 | ||

| Historical P/E | 15.1x | 13.5x | 14.3x | 9.8x | 13.2x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.80 gives a target price of $36.9 for the end of 2022. This price target implies a 6.6% upside from the September 8 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 11.2x | 12.2x | 13.2x | 14.2x | 15.2x |

| EPS – Dec 2022 ($) | 2.80 | 2.80 | 2.80 | 2.80 | 2.80 |

| Target Price ($) | 31.3 | 34.1 | 36.9 | 39.7 | 42.5 |

| Market Price ($) | 34.6 | 34.6 | 34.6 | 34.6 | 34.6 |

| Upside/(Downside) | (9.6)% | (1.5)% | 6.6% | 14.7% | 22.8% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $34.4, which implies a 0.7% downside from the current market price. Adding the forward dividend yield gives a total expected return of 3.2%. I downgraded WesBanco to a hold rating in my last report. This time around, I’ve decided to maintain the rating at hold based on the total expected return.