Gold has constantly come on high or on par with equities.

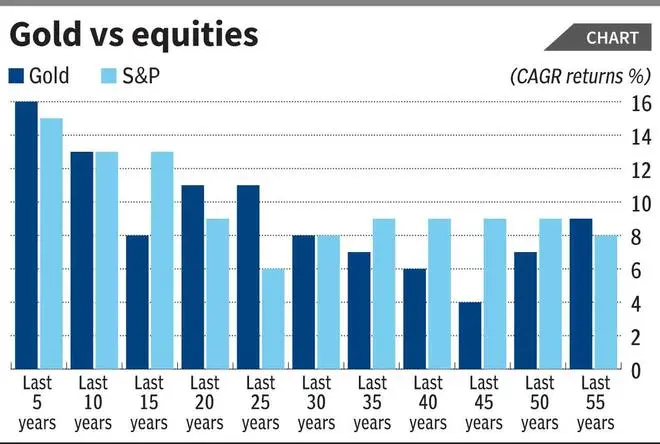

Billions of {dollars} are spent by international traders yr after yr in hedge fund efficiency charges, sell-side fairness analysis and brokerage prices to achieve entry to stylish fund administration or inventory suggestions that spectacularly under-perform gold. General, gold has constantly come on high or on par with equities (see chart 1) over the past 30 years. Additional, when one considers risk-adjusted returns, given a lot larger volatility of equities, it’s not simply outperformance by gold, however a trouncing.

What’s driving it?

Richard Nixon might have junked the gold customary and ushered in a brand new international financial order of fiat forex, however that can’t alter the basics of economics. An excessive amount of cash chasing too few items triggers inflation that debases fiat forex. Geopolitical uncertainties unnerve traders as dangers of political instability can erode belief in a forex. Central bankers and governments failing to persuade the general public that they’re critical of their intention to maintain inflation underneath management, would make them consider forex will proceed to get debased. Gold thrives in such an atmosphere, and all of the above components are at play right now.

Within the US inflation is on an uptrend, geopolitical uncertainties have elevated and tariff wars have solely added to that. Additional very excessive fiscal deficit within the US (and in just a few different developed economies as properly) mixed with the US Fed failing in its inflation mandate for 4 years continuous and but chopping charges, imply public confidence that inflation shall be tamed is eroding.

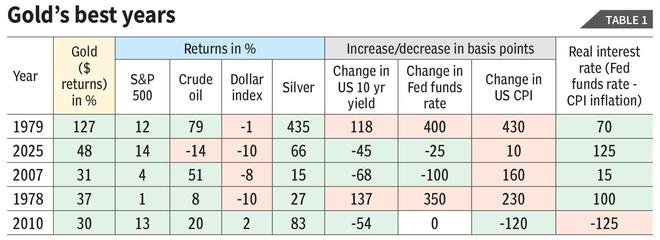

All these components have mixed to drive the yellow metallic’s 47 per cent upsurge this yr, its greatest ever because the 127 per cent returns in 1979.

However that is now historical past. What’s the upsurge signalling for traders? In any case, equities and gold and bonds have all moved up in tandem in among the years prior to now, therefore simply because gold is surging doesn’t robotically suggest there are dangers to different property.

To a get a greater perspective, we seemed on the 5 greatest years for gold within the final 50 years and the way totally different variables performed out in these years.

Unhealthy for $ index

One apparent issue is that the most effective years for gold are dangerous for the greenback index (DXY); in any case, gold efficiency is measured in USD right here. Nevertheless, it isn’t one thing that performs out each time.

In 2010, gold surged 30 per cent, however the DXY, too, was up marginally. This was a time when inflation was the very last thing on anybody’s thoughts as the worldwide economic system was reeling from pangs of the Nice Recession and the Euro Zone debt disaster. Gold, USD, any factor that was secure haven was above par for traders. Equally in gold’s greatest yr ever, 1979, the DXY was solely marginally down. This was the yr of the Iran revolution, an ideal storm of a geopolitical disaster and excessive oil costs driving inflation.

Broadly throughout gold’s greatest years, equities, crude oil, silver have all given optimistic returns. One other issue is the US client worth inflation was on an uptrend in a lot of the years. Therefore, whereas actual rates of interest had been marginally optimistic (besides in 2010), public confidence that inflation shall be tamed was missing.

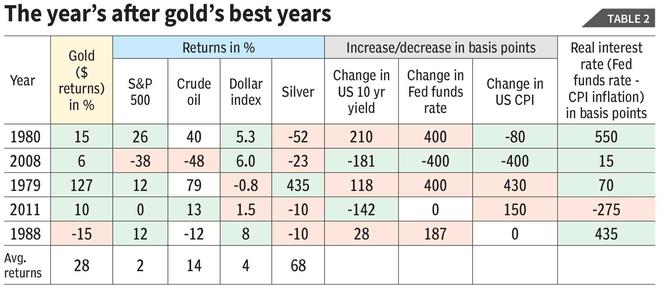

Now what’s extra necessary for traders right here? What do gold and different property do the following yr (see desk 3). The development continues! In 4 out of 5 cases, the shine within the metallic solely elevated. Buyers would have been higher off selecting gold after its greatest years slightly than selecting equities. The typical returns of the ‘subsequent 5 years’ interval is 28 per cent for gold versus a mere 2 per cent for S&P 500.

This could function a word of warning for fairness traders. Buyers (together with these in India) would do properly to keep watch over sky-high fairness valuations, the uptrend within the US inflation, and the sparring between Trump and the Fed, which is additional eroding public confidence in inflation management.

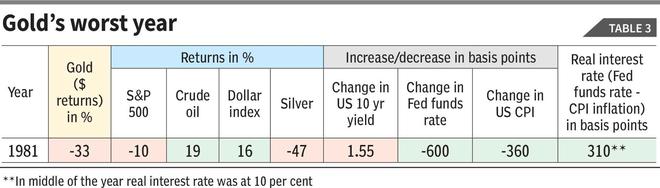

What ought to gold traders fear about? Look to 1981 — its worst yr when it fell 33 per cent. That was the yr of the Volcker shock. Paul Volcker, the Fed Chairman then, elevated fed funds charge to twenty per cent in the midst of the yr with actual rates of interest reaching a staggering 10 per cent, and introduced down inflation expectations. The DXY surged 16 per cent that yr.

The U.S. economic system entered a painful recession in 1981, largely as a consequence of the Federal Reserve’s extraordinarily excessive rates of interest geared toward combating inflation. The short-term impression was extreme, however the Fed’s decisive motion helped crush inflation and restore public confidence in its dedication to cost stability. This shift in sentiment contributed to the unwinding of the components that had pushed gold’s spectacular bull run by way of the Seventies. The top of the gold increase was adopted by the onset of a long-term secular bull market in U.S. equities, which finally culminated within the dot-com crash of 2000.

Printed on October 4, 2025