RyanKing999

By James Smith, Developed Markets Economist and Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE

We’re expecting one final rate hike from the Bank of England this week with wage growth and inflation both proving stubborn. But recent comments show the Bank is laying the ground for a pause, and we aren’t ruling that out on Thursday.

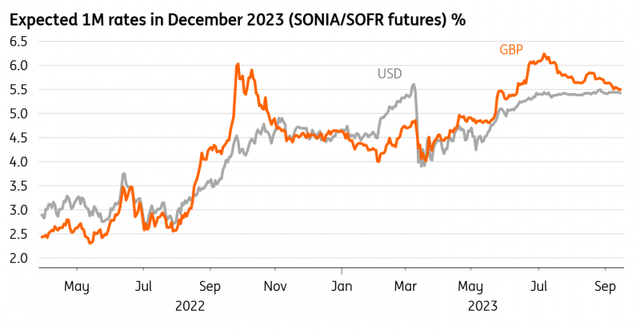

Investors have pared back BoE hike expectations

Investor expectations for the Bank of England have come a long way since the start of July. Back then, markets were pricing four more rate hikes, in addition to the one in August.

Now it’s less than two, and investors are toying with the idea of a pause from the Bank of England on Thursday. Investors are pricing a 20% chance of a ‘no change’ decision, and that follows a series of comments from BoE officials that appear to be laying the ground for a pause.

The Bank has made it abundantly clear that it thinks keeping rates elevated for a long period of time is now more important than how high they peak. Back in August, the BoE included a new line in its policy statement, saying that rates needed to stay “sufficiently high for sufficiently long”.

The Bank is now also formally describing policy as “restrictive”. That may be a statement of the obvious with rates above 5%, but it’s nevertheless significant that policymakers are now making a point of saying this.

To hammer home the message, Chief Economist Huw Pill said recently that he’d prefer a ‘Table Mountain’ profile for rates over a ‘Matterhorn’, or in other words a steadier path with a long period of no change, over a sharper pace of rate hikes and a swifter descent from the peak.

Markets have lowered expectations for peak Bank Rate

Macrobond

Could we get a pause on Thursday?

This is a simple reflection of the UK mortgage market, where roughly 85% of lending is fixed, albeit for a relatively short amount of time. The average rate being paid on outstanding mortgages has risen from 2% to 3% so far, and we expect that to rise above 4% next year even if the BoE doesn’t hike rates any further.

That’s why the Bank is making it its mission to convince investors that rates need to stay high for a long time, and any further rate hikes should be seen as a tool to meeting this end. It does feel like the Bank is actively trying to set the stage for a pause.

Could that happen this week? We wouldn’t totally rule it out. Policymakers will have had a keen eye on the Federal Reserve, which has succeeded in pushing back rate cut expectations with the so-called “skip strategy”.

By drawing out its tightening cycle by pausing at every other meeting, the Fed has managed to keep the conversation about how many hikes we have left, rather than how long it will take before we get rate cuts.

A similar strategy, whereby the BoE pauses in September but hints strongly that it could hike again in November, could be tempting for policymakers this week.

Our base case is one more rate hike

None of that is our base case though, and we’re expecting one final hike on Thursday.

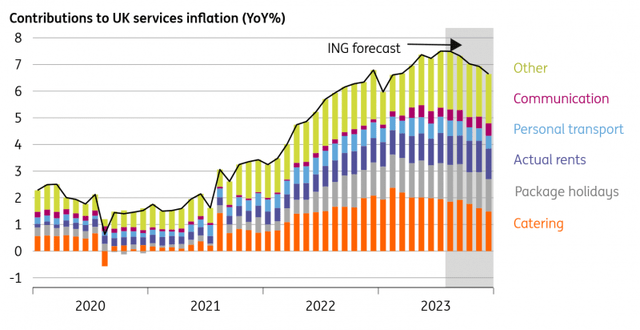

The reality is that both wage growth and services inflation, the two key metrics upon which the BoE is basing policy, are higher than forecast back in August. We also still have one round of CPI data due the day before the meeting, and we expect services inflation to nudge slightly higher again.

Still, look closely enough and there are signs that wage growth may be starting to ease.

The jobs market is clearly cooling now too, while a range of surveys suggest that fewer firms are raising prices, not least because lower energy prices are taking pressure off service sector costs.

We expect this to show more readily in the services CPI numbers over the next few months.

That means the Bank can probably afford to end its tightening cycle this week. Assuming though that the fall in services inflation and wage growth is pretty gradual, we think a rate cut is unlikely until at least the second quarter of next year.

Services inflation should start to come down later this year

Macrobond, ING forecasts

Expect a faster pace of quantitative tightening (QT)

The other decision the Bank will be making this week is on quantitative tightening as it decides whether to ramp up the pace over the next 12 months. The stock of gilts due to mature over the next year is roughly £10bn higher than over the last.

The Bank has also completed its unwind of corporate bonds over the past year, and the implication is that it might boost gilt sales over the next 12 months to compensate.

We therefore think the Bank will plan to reduce its gilt holdings by roughly £100bn over the next 12 months, up from £80bn over the last.

GBP: Biggest FX reaction comes on a pause

On a trade-weighted basis, the sterling has had a good year. It is still up over 5% year-to-date, although is now around 2% off the highs seen in July.

Driving a large portion of that trend has been expected Bank of England rate policy. Most notably, the recent repricing in the BoE terminal rate towards the 5.60% area from a peak near 6.50% has explained a large part of the sterling’s softness over the last couple of months.

As policy tightening cycles in the G10 (ex-Japan) policy space reach their conclusions, one could argue that 8-10bp adjustments in money market curves will contribute only noise, not trend to FX markets.

And certainly, an as-expected 25bp BoE rate hike Thursday amid some hawkish rhetoric looks unlikely to be a game changer for the sterling.

That said, a surprise pause would have a big impact on the sterling. And while the BoE may try to market a pause like a Fed ‘skip’, the market would doubt that the BoE would be in a position to raise rates later in the year.

The FX options market prices a 95bp GBP/USD range for the 24-hour event risk covering the Fed and BoE meetings this week. A BoE pause could well push cable below the May lows just above 1.2300.

Perhaps surprising to some has been the sterling underperforming the euro too – despite very poor eurozone confidence figures and the European Central Bank pointing to the end of the tightening cycle.

Again, this looks largely down to the greater downside for expected UK interest rates – a factor which should weigh on the sterling into 2024. Our year-end 2023 EUR/GBP forecast remains 0.8800.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.