Opposite to fashionable perception, the way in which companies handle their cash is damaged. With no clear view of their monetary well being, it’s important to implement order by way of modernization, automation, and enhancement of current workflows and processes offering synchronal visibility. Volopay, a Y Combinator-backed Singapore-based company playing cards, and payable administration startup are poised to sort out and repair this downside.

Having raised $29 million in Collection A, a mixture of fairness and debt, Volopay is all set to develop to APAC and MENA markets.

The spherical included participation from JAM Fund, Winklevoss Capital Administration, Accial Capital, Rapyd Ventures, Fintech veteran Jeffrey Cruttenden – Founding father of Acorns together with Entry Ventures, Antler World, and VentureSouq.

Justin Mateen, founding father of Tinder and JAM Fund who led the spherical, stated in an announcement, “I’ve labored carefully with Volopay’s superb group since my unique funding on the pre-seed stage. Given the accelerating development of the enterprise, and the group’s capability to innovate shortly on the product facet with a single stack scalable platform throughout a number of jurisdictions, it was solely pure to triple down and lead the Collection A spherical. I’m proud to companion with a frontrunner on this area and to assist assist Volopay to scale to larger heights”.

With Volopay firmly putting itself into the Australian and Singaporean markets, it now eyes on all the APAC area together with the MENA enlargement on the horizon.

The extremely anticipated launch into a number of markets is essential because the development prospects are immense. “With APAC & MENA churning out a number of unicorn degree enterprises yearly, it’s certainly making an enormous wave on the worldwide frontier. And that is solely the start. Accelerating their development would require an environment friendly expense administration device that’s easy but scalable, one thing that Volopay has all the time aimed for,” stated Rajith Shaji and Rajesh Raikwar, Co-Founders of Volopay.

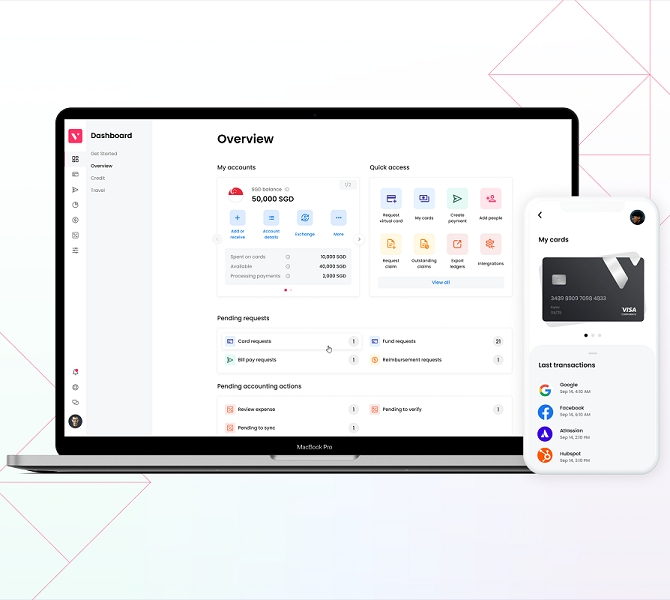

The profound disconnect between the finance and enterprise operations of most organisations is a significant problem. Volopay focuses on constructing processes important to boost the coaction of those two capabilities. Bringing these two silos collectively beneath a single roof, the system will naturally assist companies save money and time in order that they get to give attention to extra urgent issues. The mixing and automation of a seamless FinOps perform give Volopay a major aggressive edge.

Rajith stated, “Volopay is an bold mission. To construct an alternative choice to Volopay, you’d should launch 5 totally different startups. We’re constructing the management centre for contemporary corporations for all their monetary administration wants. Our platform is as straightforward and seamless to make use of for a 5-person firm, as it’s for a 500-person firm. We wish to take our imaginative and prescient of a unified spend administration platform to all corporations the world over after our preliminary markets of APAC and MENA.”

Volopay’s mission is to not merely construct a enterprise. What they’re doing is pushing change in each market they step foot in, altering the way in which companies deal with, handle and have management over their cash.

Volopay is disrupting conventional enterprise banking and goals to be adopted as the only and solely resolution rising, world companies want for his or her playing cards, bill automation, and invoice funds together with the added bonus of a multi-currency enterprise account with out the trouble and limitations of a standard financial institution.

To attain this, Volopay has launched into the bold goal of constructing its personal infrastructure and making use of for monetary licenses in its markets.

Rajith stated, “A lot of our opponents world wide will choose to combine with Third-party infrastructure suppliers to supply monetary companies. This limits the kind of merchandise you may supply shoppers, and with every area taking part in host to its personal community suppliers, it’s virtually not possible to ship a constant and pleasant buyer expertise for our world firm shoppers working in several elements of the world. We’re doing one thing no different firm has performed regionally, we’re constructing our personal infrastructure. Not being held again by the restrictions of an middleman, this basis won’t solely allow us to create extremely revolutionary monetary merchandise, but in addition a pleasing and dependable buyer expertise throughout all our markets.”

Since its seed funding, Volopay has grown exponentially to raised alleviate its shoppers’ ache factors. With a 150+ member group unfold throughout main enterprise centres within the Asia Pacific area, resembling Singapore, Australia, India, Indonesia, and the Philippines, Volopay has amassed a powerful clientele with the likes of Deputy, m-View, and Code Camp amongst others.

Nevertheless, extra work stays to be performed on this trade, says Rajith. Probably the most urgent issues that SMEs and startups face at the moment is the excessive FX fees incurred for worldwide funds and the shortage of a uniform platform accessible to entry all spend knowledge.

Volopay’s foray into the APAC and MENA markets is to sort out exactly the issue acknowledged above by offering corporations with multi-currency wallets to carry cash of their base forex and any main forex – USD, AUD, EUR, GBP – and subsequently use it for payouts. This can assist utterly get rid of exorbitant quantities of FX fees levied on worldwide funds.

“We offer rising companies, startups, and enterprises flexibility and a premium expertise by issuing playing cards and processing cash transfers – home and worldwide. And within the case of a multinational firm with entities unfold throughout the globe, Volopay supplies a single go-to-platform for the whole lot cash and finance to remain related and updated throughout their world areas and groups,” stated Rajith.

A part of Volopay’s Collection A funds can be put in direction of their forthcoming market launches, constructing and innovating new applied sciences to enhance their current product.

The corporate can be investing in enhancing its integrations with fashionable ERPs, HRMs, and CRM software program together with main mission administration functions. The corporate can also be hiring aggressively for key positions in every of its markets.

Michael Shum, Chief Funding Officer at Accial Capital stated, “Accial Capital views the B2B company spend vertical as a solution to assist entrepreneurs and SMEs with liquidity and shut the credit score hole. Volopay has a terrific bold group centered on redlining the finance workflows with its sturdy know-how. We’re proud to companion with a frontrunner on this area to assist scale.”