Editor’s note: Seeking Alpha is proud to welcome Chris Chng as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Luis Alvarez/DigitalVision via Getty Images

Executive summary

Workday, Inc. (NASDAQ:WDAY) is a leading provider of cloud-based human capital management and financial services software. It has 60 million users across 9,500 companies globally, which includes over 50% of the Fortune 500 and 25% of the Global 2,000 companies. Since its IPO in 2012, it has consistently registered an average annual revenue growth of ~30% with a significant majority being recurring subscription revenue which makes up 90-95% of Workday’s revenue. It has many traits of a great company – market leadership in large TAM markets, high retention rates amongst blue chip clients and a robust balance sheet. Furthermore, it has struck a good balance between growth and profitability by achieving the rare “Rule of 40” SaaS status in the most recent fiscal year, with revenue growth of 21% and non-GAAP operating margins of 20%.

However, with the recent tech bull run, Workday’s share price has increased by >20% in the last 6 months. This makes the stock slightly overvalued, and I would sit on the sidelines for now and wait for a better valuation to come by. I initiate coverage of Workday with a Hold rating at a price of $192.

Investment thesis

Massive and growing TAM

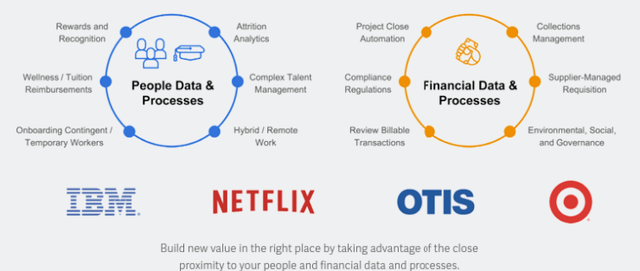

According to Allied Market Research, the global human capital management (“HCM”) and global financial services software market were valued at $22 billion and $119 billion respectively in 2021 and were projected to grow at a CAGR of ~9% to 2031. With remote and hybrid work becoming the new norm, more companies today are looking for ways to improve their decision-making process through data and create productivity uplifts for their workforce.

Source: Workday investor presentation

With a strong and growing suite of solutions across human capital management and financial services software, I believe Workday is well-positioned to benefit from the growing demand from these massive industries.

Significant market leadership

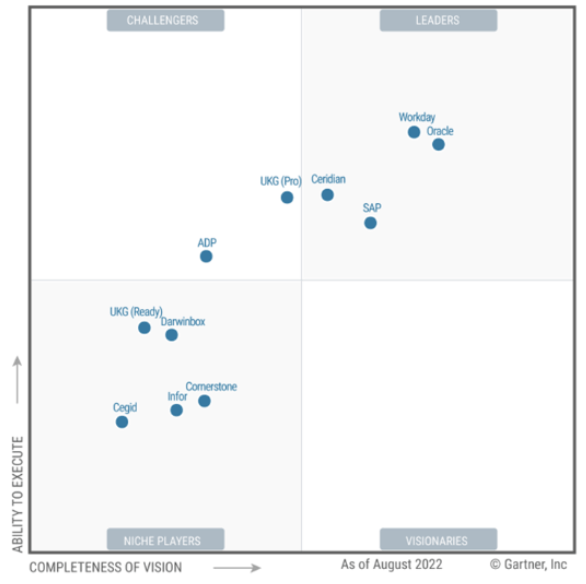

Naturally, large industry TAMs also attract more competition, as everyone wants a slice of the pie. The HCM and financial services software markets are often considered to be legacy SaaS segments that are highly competitive with a good mix of large, established players and up-and-coming startups. That said, I do believe that Workday has a strong economic moat over its competitors. From a market share perspective, Workday is the number 1 player in the HCM market with 27% market share, followed by 20% for Oracle Corporation (ORCL) and 15% for SAP SE (SAP). This showcases Workday’s ability to win market share against incumbents despite having a much shorter operating history. Most recently, it has also been named as a leader for Cloud HCM Suites for 1,000+ Employee Enterprises by Gartner for the seventh consecutive year.

Source: Gartner Magic Quadrant

While it is not a market leader in the financial services software space as yet, I am confident that Workday can replicate the success of their efforts in the HCM space given their track record and the cross-selling synergies between the finance and HR software solutions.

Blue chip diversified clientele base with high retention rates

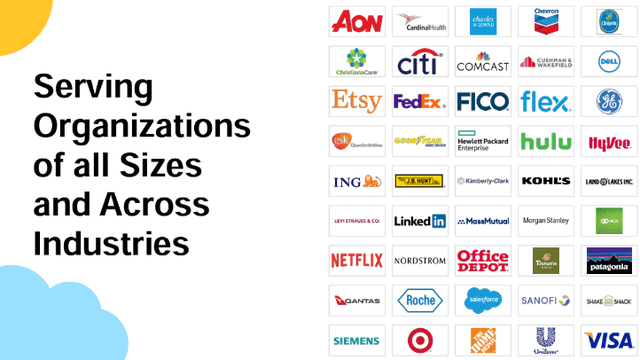

Workday currently has 60 million users across 9,500 companies globally, which includes over 50% of the Fortune 500 and 25% of the Global 2,000 companies. This portfolio is especially impressive considering that they also have >95% gross revenue retention rate on a predominant subscription-based and recurring revenue stream. The high switching cost for Workday’s product across a wide variety of industries and company sizes points to Workday’s competitive advantage over its peers.

Source: Workday investor presentation

Improving profitability and robust balance sheet

In the most recent fiscal quarter, Workday has broken even on a GAAP basis. On a non-GAAP basis, the company has earned $1.31 which is well ahead of analysts’ consensus at $1.12 per share. This is comforting news given the uncertain macro environment and growing concerns around Workday’s lack of profitability over the past few years.

On its balance sheet, Workday recorded $6.0 billion worth of cash and cash equivalents. Dividing that by the current liabilities of $4.0 billion gives us a cash ratio of 1.5 which shows that Workday has more than sufficient liquidity in the short-term. Having additional funds also means more opportunities for M&A to accelerate revenue growth, as there are likely more distressed companies that are unable to raise funds in the current startup fundraising drought. On the debt side, Workday has a debt / revenue ratio of 48% with $3.0 billion of non-current debt sitting on Workday’s balance sheet. This is lower than the average debt / revenue ratio of 75% for public SaaS companies, based on a private analysis conducted by Capchase.

With sufficient liquidity, reasonable debt load and improving profitability, I am confident that Workday is better positioned than most SaaS companies to outperform in an uncertain macro environment.

Valuation

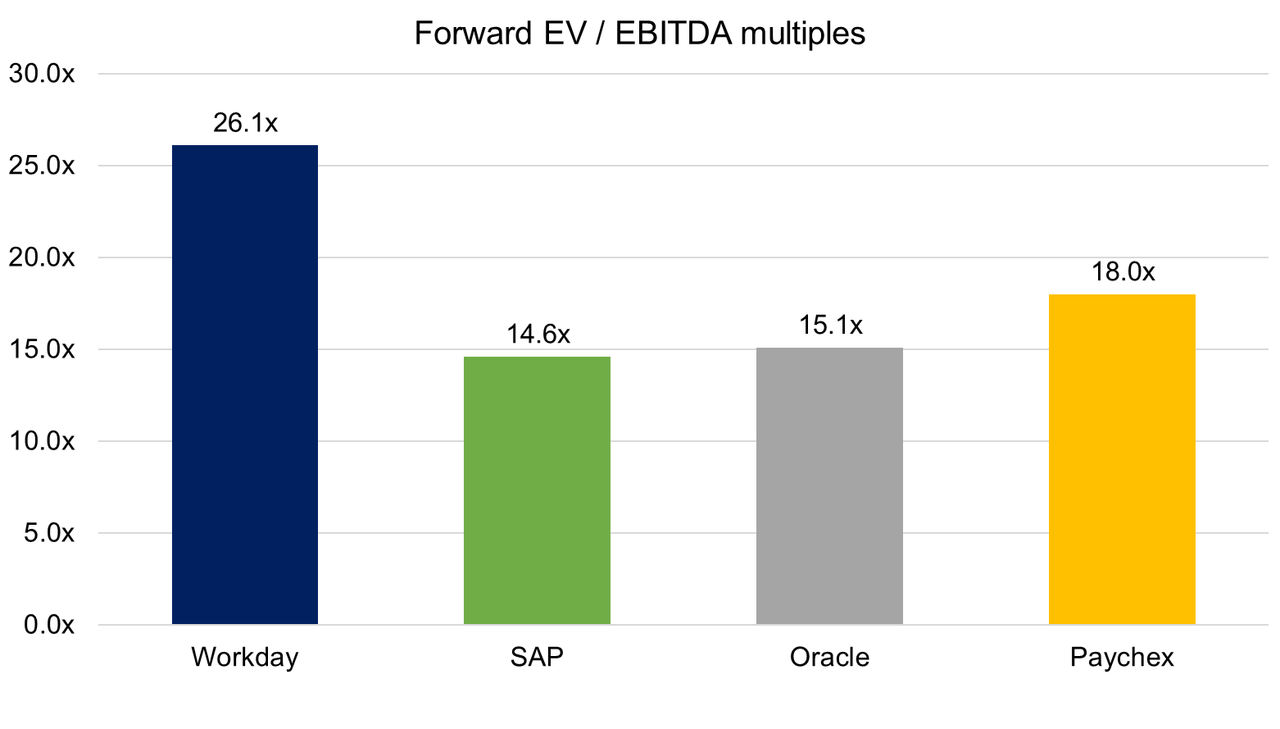

As fundamentally sound as Workday might be, I believe that it is currently slightly overvalued, and I would prefer to sit on the sidelines for now. This is seen on 2 fronts. Firstly, from a forward EV / EBITDA perspective, Workday is currently trading at 26.1x which is at a 64% premium to the average of 15.9x from SAP, Oracle and Paychex, Inc. (PAYX). I would pick Workday over these peer companies from an investment perspective, but not at such a steep premium.

Source: Seeking Alpha

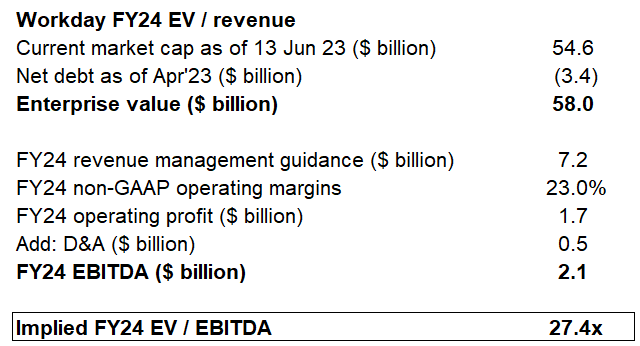

Secondly, I tried to calculate the implied FY24 EV / EBITDA based on the latest FY24 management guidance to compare against its current forward valuation to determine if it is overvalued. To be conservative, I used the lower end of management guidance for revenue of $7.2 billion to derive the FY24 operating profit based on 23% non-GAAP operating margins as provided by the company. I then added back the forecasted FY24 D&A which I assumed to be 6% of total FY24 forecasted revenue based on the historical D&A to total revenue percentage. Finally, this gives me an implied FY24 EV / EBITDA of 27.4x. What this demonstrates is that even with the lower end of management guidance, we are getting a sizable premium over Workday’s current forward EV/EBITDA multiple and its peers, as shown in the chart above.

Source: Author’s calculations based on Workday’s management guidance

The above methodologies suggest that Workday is currently slightly overvalued. To have a larger margin of safety, I would be more comfortable if Workday is trading closer to 22x FY24 EV/EBITDA which is at a 38% premium to the peer average of 16x. I believe the premium is reasonable because Workday has a double digit forward revenue growth of 18% vs its peers that are getting single digit revenue growth rates – SAP of 6%, Oracle of 11% and Paychex of 9%. At 22x FY24 EV/EBITDA multiple, the implied share price is $192.

Key risks

While Workday is a compelling long-term buy for me, there are two top-of-mind concerns for me. Firstly, competition. In legacy SaaS markets like HCM and financial services software, there are a good mix of large, well-capitalised players like SAP and Oracle and small emerging startups like BambooHR and Ripping. While I take comfort in Workday’s market leadership position and the high switching cost of its product, I would always carefully monitor recent developments from its competitors. For instance, SAP recently announced an extensive expansion of partnership with Google Cloud on introducing a comprehensive open data offering. Besides, the high switching cost nature of HCM and financial services software product would also hurt Workday, as it would get increasingly difficult for the company to gain market share at the expense of its competitors.

Secondly, Workday also has fairly significant share-based compensation expenses, which are not captured under non-GAAP margins. As of the latest fiscal year, Workday has a total share-based compensation of $1.3 billion, which represents 21% of its FY23 revenue. This share-based compensation as a % of revenue is significantly higher than other blue-chip tech companies such as Meta Platforms Inc. (META), Amazon.com Inc. (AMZN) and Alphabet Inc. (GOOG) of 10%, 4% and 7% respectively.

Conclusion

Workday is a solid company with strong fundamentals. Coming from a product led startup myself, I find Workday’s market leadership in the HCM space and high revenue retention rate of 95% amongst blue chip clients to be highly impressive. The combination of these data points creates a strong economic moat for Workday that is difficult to replicate without significant R&D dollars and time. In the event that I see these metrics starting to falter due to the emergence of new technology or a breakthrough from any of its competitors, I might revise my rating to SELL. Until then, I believe that Workday is a compelling long-term buy.

That said, great companies at the wrong price make a bad investment. With the recent surge in Workday’s share price, I would prefer to stay at the sidelines until the share price falls below my target price of $192 before starting a position in the company.