DKosig

Investment Thesis

2023 was a year of strong performance for the Communication Services sector. Stocks like Meta Platforms (META), Netflix (NFLX), and Alphabet (GOOG) led the rebound from the front as their individual earnings outlook improved and investors attempted to rebuild the enthusiasm on the back of a gruesome 2022.

The performance of this sector can be seen in the Communication Services Select Sector SPDR Fund (NYSEARCA:XLC), which tracks the Communication Services sector. XLC has outperformed the S&P 500 Index on a trailing 1-year basis, as can be seen below.

XLC fund vs S&P 500 Index: 1 Year trailing (sa)

However, I believe there are few catalysts in motion that act as tailwinds for communication services and digital ad stocks, making the XLC a beneficiary. While there may be some short-term volatility given the run most stocks have had this year, long-term prospects are strong for XLC. I rate this as a Buy.

About the Communication Services Select Sector SPDR Fund

The Communication Services Select Sector SPDR ETF is managed by State Street’s SSGA asset management arm. As per the fund prospectus, the XLC fund offers investors exposure to a range of companies in the Communication Services sector, such as Interactive Media & Services, Entertainment, Media, and Telecommunication stocks, that are listed on the S&P 500 Index.

The objective of the fund is to track the price and yield performance of the S&P Communication Services Select Sector Index. As with all sectoral indices managed by S&P, stocks in the Communication Services sector index must be listed on the S&P 500 Index, and index constituents are rebalanced quarterly. I also wanted to note that this index is relatively new and was formed as an evolution of the old telecommunications sector index when GICS decided to expand the scope of this sector to include stocks such as Meta and Google, whose businesses revolve around emerging areas such as digital media and social networks.

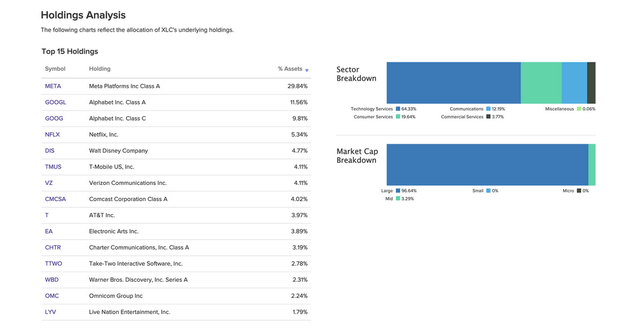

I have added a chart below that shows the Top 15 Holdings vs. the Constitution of XLC’s Funds by categories.

Top 15 holdings for the Communication Services Select Sector ETF (etfdb)

Peer Comparison

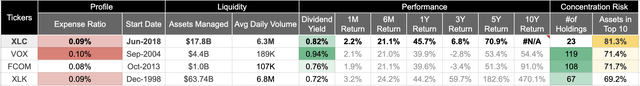

From the chart added above, the heavy top of XLC’s asset base clearly stands out. Meta itself accounts for a third of the fund’s assets, while Alphabet’s twin stocks combined with Netflix account for slightly over a fourth of the fund’s assets. Together, Meta, Alphabet, and Netflix make up 55% of the fund’s assets. The remaining 45% of the fund’s assets are distributed among 19 other stocks. As can be seen in the peer comparison table below, the fund has its assets distributed among 23 stocks, making it meaningfully concentrated.

Comparing the XLC fund to its peers and the XLC fund (sa)

XLC’s asset concentration significantly diverges from that of its direct peers, Vanguard Communication Services Index Fund ETF (VOX) and Fidelity MSCI Communication Services Index ETF (FCOM). That divergence between XLC and its direct peers arises because both FCOM and VOX track the MSCI US IMI Communication Services spliced index, which follows a different index composition strategy. However, I will note that with all the concentration risk that XLC carries, the fund still outperforms its immediate peers on almost all time horizons. In fact, on a one year basis, XLC can also be seen outperforming the Technology Select Sector SPDR® Fund (XLK).

However, I will also add that XLK outperforms XLC on 3-5 year horizons. This implies that the XLC may be viewed as a sector rotation play, especially when the macro outlook starts improving in favor of the XLC.

Outlook for FY24 and beyond

So far, the outlook for communication stocks looks promising. I will start with the macro outlook below.

Macro Outlook for the Communication Services sector

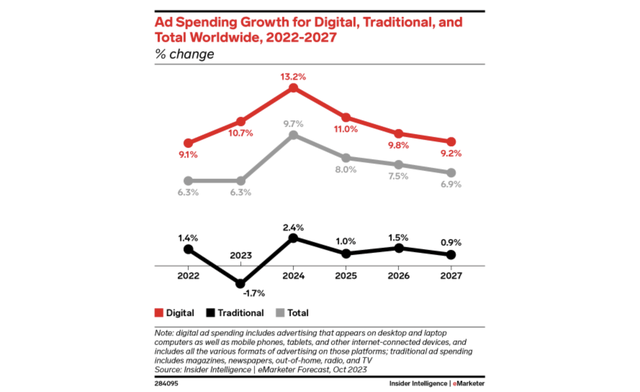

Most stocks that are part of the Communication Services sector today rely on robust spending in the advertising landscape. In addition, for the advertising landscape to be robust, the general outlook needs to get incrementally better. So far, stable interest rates and a resilient consumer have staged the rebound in the overall economy, which has reversed business spending in advertising. This has further improved the outlook for digital ad spending. Earlier this year, a forecast by eMarketer projected total ad spend in FY24 to increase by 9.7%. This increase is expected to be led by a rebound in digital ads, while traditional ad spend projections also return to growth mode again, as seen below.

Total ad spend is set to increase again in 2024 after a strong 2023 which is good for Communication Services stocks (eMarketer)

Meta’s strong earnings report has already added more fuel to the optimism in this space for the year, which is also noted by FactSet in the 16.4% upward revision for Meta’s Q1 expectations.

Valuations for XLC fund

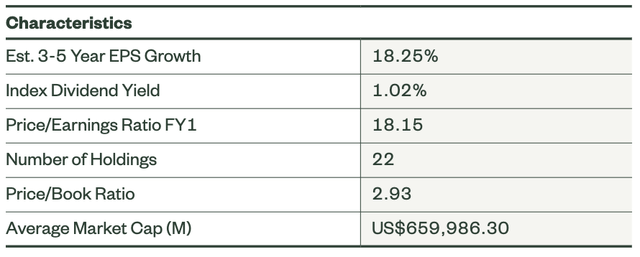

To estimate the value of the XLC, I looked at the expected earnings growth and compared the premiums that investors are paying to invest in the XLC today vs. the general market. The fund’s fact sheet projects that the expected EPS growth over a 3-5 year period is ~18.3%, as shown below.

XLC’s expected earnings vs forward premiums (SPDR Exchange Traded Funds (ETFs) | SSGA)

Also, investors are paying a forward premium of 18.15 for those expectations. This is very reasonable, in my opinion, given that investors are also paying 20.6x to invest in the S&P 500 for 11% growth in earnings this year and 13.3% growth in FY25.

Moreover, XLC’s peer valuation vs. the XLK offers better comparative returns given that the XLK currently trades at 28.4 times forward earnings while 3-5 year EPS growth is expected to be ~13.5%.

Risks to Bull Thesis

A high dollar would be a strong headwind for most components in the XLC. So far, the dollar index (DXY) is up ~2.2% for the year but still remains range-bound. Higher interest rates or other events, such as global instability, would raise the dollar, creating pressure for stocks in the XLC. Further, a sudden slowdown in the economy would hit most stocks in this fund, causing a rerating in the growth prospects for the overall Communication Services sector and other technology stocks.

Finally, with 2024 being an election year, I believe investors should expect some volatility in these stocks, especially since Meta and Google operate large social networks. But I believe in the fundamentals of both of these companies, and I believe the election coverage and the need for users to go online and be updated or read opinions in an election year would be a plus for these stocks and the XLC.

A small caveat to my bullish thesis is that there may be some short-term volatility in the markets due to the impressive runup this year. I had noted earlier how a pullback may be coming, but XLC’s valuation levels are really appealing to me at these levels.

Conclusion

There are some potent tailwinds that are present for the Communication Sector complex, which are positioning the ETF for some strong returns. A better-looking earnings outlook, reasonable valuations, and a robust macro environment are, in my opinion, setting the stage for a strong year for the XLC. I rate the XLC as a Buy.