utah778

Market Recap

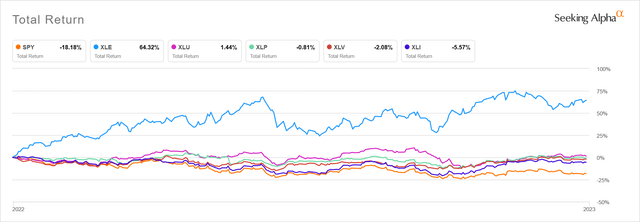

2022 was the worst year since 2008 with the S&P 500 index ETF (SPY) returning -18.2% including dividends. The top sector was no surprise. Energy (XLE) was the clear winner with a 64.3% total return as measured by the Sector SPDR ETF. The next 3 best performers were the classic defensive sectors. Utilities (XLU) was the only other positive sector at 1.4%, followed by Consumer Staples (XLP) at -0.8% and Health Care (XLV) at -2.1%. These three sectors all had small positive returns in the second half, as did the overall S&P 500.

Energy had a very strong second half, as did Industrials (XLI) at -5.6% and Financials (XLF) at -10.6%. These last two sectors finished about 10 percentage points better than where they stood at midyear. The good performance of these cyclical sectors feels more like a recovery signal than a recessionary one.

Seeking Alpha

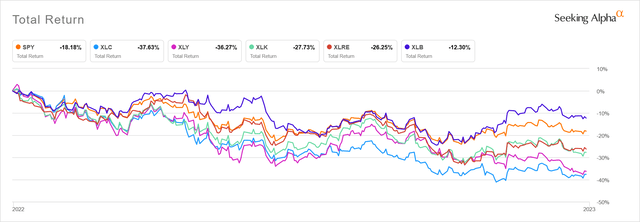

The worst sectors were Consumer Discretionary (-37.6%), Communications (-36.3%), and Technology (-27.7%). All three of these sectors have a negative second half as well. although Technology ended only slightly worse compared to the first half. Sector performance went pretty much as I expected in my November 2021 article, “Surviving A Tech-Led Bear Market: Lessons From 1999 To 2002”.

Seeking Alpha

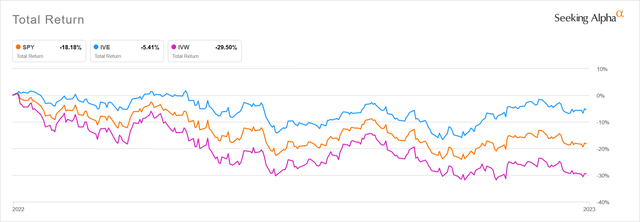

Value clearly beat Growth in 2022, an extension of the first half performance. The iShares S&P 500 Value Fund (IVE) returned -5.4% for the year compared to -29.5% for the Growth Fund (IVW).

Seeking Alpha

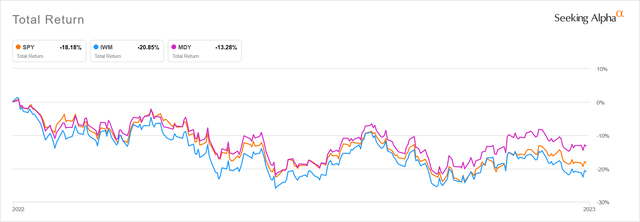

Performance by market cap was like a bell curve: highest in the middle and lowest at both ends. S&P MidCap ETF (MDY) returned -13.3%, outperforming SPY by 4.9%. The iShares Russell 2000 ETF (IWM) returned -20.9%, underperforming SPY by 2.7 percentage points.

Seeking Alpha

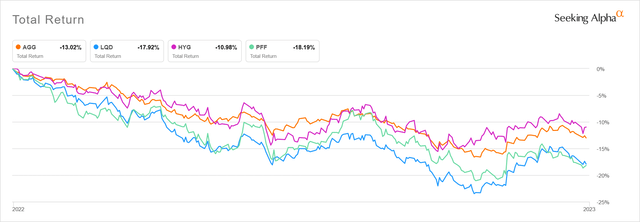

Bonds continued to perform terribly in the rising interest rate environment. The iShares Core U.S. Aggregate Bond ETF (AGG) returned -13% in 2022. Outside of the AGG, lower credit quality fixed income index ETF’s did better than higher quality ones. The Investment Grade Corporate Bond Fund (LQD) returned -17.9%. The High Yield ETF (HYG) returned -11.0% and the Preferred ETF (PFF) returned -18.2%.

This apparent lack of worry over credit quality seems like another contraindication of a recession in 2023.

Seeking Alpha

My portfolio’s lack of mega-cap growth was a positive performance driver throughout 2022 as it was in the first half. Reducing riskier fixed income allocation in the first half also helped. However, I began increasing this allocation again in the second half as better-quality high yield and low-end investment grade bonds with 5 to 10-year maturities yielding of 5% to 6% were available. The market appears to now be sensing that a peak has been reached in inflation as indicated by recent drops in longer-term interest rates. Whether you believe the Fed or the market, only 2 or 3 0.25% rate hikes are likely in the Fed Funds rate. The window to buy bonds at attractive yields could close in 2023 and leveraged closed end bond funds appear poised for recovery as NAV’s increase and the cost of leverage peaks.

As far as stocks are concerned, value has some potential outperformance remaining if this market proceeds like it did after bottoming 21 years ago in 2002. High quality stocks normally thought of as “growth”, such as large cap tech names with good earnings and cash flow also now look attractive with lower multiples. I would continue to avoid the low-quality growth stocks that got beaten up the most during the bear market. These can bounce a lot at the start of a new bull market, but the risk of timing this incorrectly is not worth the potential reward.

Portfolio Performance

My portfolio beat the S&P 500 by 12.1% 2022, the best relative performance since 1999, returning -6.1% compared to -18.2% for the SPY. My ending asset allocation was 83.9% equities, 15.6% fixed income and preferreds, and 0.5% cash. That marks a shift of 0.2% out of equities, 1.7% into fixed income, and 1.9% out of cash compared to the allocation at midyear 2022.

As for investment income, I had a yield of 2.7% in 2022 based on starting portfolio value. This more than doubled the 2022 SPY yield of 1.3%. Higher yielding bond purchases in the second half helped to drive this yield, as well as generous special dividends from John B. Sanfilippo & Son (JBSS), PIMCO Dynamic Income Opportunities Fund (PDO) and the pre-merger special from Change Healthcare when it was acquired by UnitedHealth Group (UNH). My portfolio income in total dollars was 7.1% above 2021 levels. Looking forward, my projected yield for 2023 is also 2.7%, but this is before any dividend raises or specials.

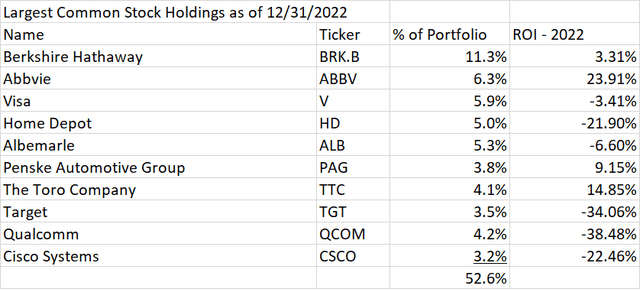

Largest Holdings

My top 10 common stock holdings make up over half of my total portfolio. Once again, I made no trades in these names outside of reinvesting dividends. The names on the list are the same as at midyear 2022 except that Thermo Fisher Scientific (TMO) has fallen off the list due to price performance and was replaced by Toro (TTC) which had a strong year as its Professional segment continues to drive growth despite flat results in the Residential segment.

Author Spreadsheet

Six of the top ten holdings outperformed the S&P so far in 2022. The other four fall into the lower-performing Tech and Consumer Discretionary sectors. Fortunately, only one holding in the top 7 underperformed the S&P. Three of the four underperformers for the year seem to have bottomed already as they had positive returns looking at the second half only, beating the S&P. QUALCOMM (QCOM) is the only one that continued to underperform in the second half. I am not worried about Qualcomm for the long term, as it is expanding non-phone related applications such as in the automotive field. In the nearer-term, results are still driven by smartphone sales, but even this should improve in 2023 with China reopening.

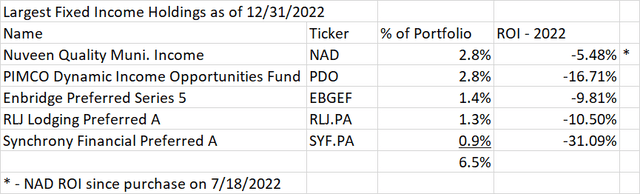

My top 5 fixed income holdings make up another 6.5% of my portfolio. I made one major trade on this list, replacing the state-specific Nuveen Ohio Quality Income Municipal Fund (NUO) with the corresponding national fund (NAD). I discussed the rationale for this in July 2022, although I have been wrong so far, with NAD underperforming NUO by 6.5%. This is probably due to the higher leverage of NAD in the increasing short-term interest rate environment. I expect this to be less of an issue in 2023 and in any case, NUO is merging in 2023 with some other small state-specific funds into a lower quality fund. The bump in NUO price at the merger announcement also helped its performance in the second half.

Synchrony Financial preferred (SYF.PA) was easily the worst performer with credit worries and its BB- rating, but customer default rates have turned out lower than expected in previous recessions. The common stock looks cheap to me even if loan losses increase so investments higher in the capital structure look even safer. With a current yield approaching 7.9%, I think the risks of any upcoming recession are priced in.

Author Spreadsheet

Top And Bottom Performers

My third best performer in 2022 Mitsui & Co. (OTCPK:MITSY) with a return of 26.6%. This Japanese trading company benefitted from commodity inflation in 2022 and used its strong cash flow to continue strengthening its balance sheet and increasing the dividend.

The second-best performer was Western Midstream Partners (WES), the MLP affiliated with recovering upstream producer Occidental Petroleum (OXY), at 28.8%. As I have noted in several articles, the partnership has returned to throughput growth after improving its balance sheet by shedding debt and focusing its capital spending. I expect WES to pay out a special distribution under its new policy in 1Q 2023.

The star performer of the year was Constellation Energy (CEG) with a return of 74.8% since it started trading on 2/2/2022. The stock far surpassed my expectations following the spinoff from Exelon (EXC) thanks to its concentration in nuclear power and the subsidies available in the Inflation Reduction Act. I believe this impact is now fully priced in, but the stock is still a good long-term hold given the ongoing demand for energy from low-CO2 emitting sources.

The third worst performer of 2022 was Target (TGT) at -34.1%. Most of that came when the company slashed its operating margin forecast when reporting 1Q results. Target was caught off guard like many retailers when consumers switched their buying patterns to staples and lower-priced goods in response to inflation. The company should do well in the long term as it clears out the unwanted inventory and adjusts buying patterns. The omnichannel strategy initiated in 2020 and 2021 has made the chain more efficient and capable of meeting online as well as in store demand.

The second worst performer in 2022 was Qualcomm, at -38.5% as discussed above.

My worst performer of 2022 was Warner Bros. Discovery (WBD), with a return of -59.3%. The company came public at a bad time for the market with a lot of debt and market revulsion toward anything streaming-related given Netflix’s (NFLX) unexpected loss of subscribers. After a couple quarters of combined operation with the merged Discovery and WarnerMedia, CEO David Zaslav has found he has more work to do than originally thought correcting the bloated management and bad investments of the AT&T years. This will result in several more reports of write-downs and restructuring, yet the company’s media franchises can be generous cash cows if run properly. With WBD down to 0.5% of my portfolio, I will stick around for the show to see if Zaslav can make it work.

Special Situations

The special situations area became much less attractive in the second half of 2022 as higher interest rates provided lower-risk opportunities for short-term investments compared to merger arbitrage. Many deals closed in the first half of the year as I discussed in my midyear review. I did not enter into any new deals in the second half.

Change Healthcare finally closed its cash buyout by UNH after prevailing in court. This deal produced a 14.5% capital gain on positions initiated in June and November of 2021, as well as a $2.00 special dividend which added another 8.9%.

Shaw Communications (SJR) now looks likely to close its merger with Rogers Communications (RCI), so the earlier decision to close my Shaw position turned out to be a bad one. Given the uncertainty at the time and the small positive return still earned, I am not that disappointed.

The remaining deal is the merger of Activision Blizzard (ATVI) with Microsoft (MSFT) for $95 cash. This deal continues to be opposed by the US and some European governments even as it is gaining approval in other countries. The concerns appear unfounded as the merger is vertical, not significantly increasing concentration in the industry. Microsoft has also committed to allow other gaming platforms access to Activision games like Call of Duty. Even if the merger does not go through, Activision now looks more valuable than it did a few months ago thanks to the good performance of its latest release in the CoD franchise, Modern Warfare II.

Other Trades

Aside from the NUO / NAD swap and the Change Healthcare deal closure mentioned above, trading activity was typically light in the second half of 2022. In July, I used the proceeds from the Shaw sale to buy bonds of Western Midstream (4.75% due 2028), Synchrony Financial (3.95% due 2027), and Tennessee Valley Authority PARRS due 2029 (TVE). In August, I sold Exelon (EXC) and added to positions in higher-yielding investments PDO, Barrick Gold (GOLD), ITOCHU (OTCPK:ITOCY) and AT&T (T). Also in August, I received a tender offer for EnLink (ENLC) bonds which I replaced with TravelCenters of America 8% baby bonds due 2029 (TANNL).

In October, I put the proceeds of the Change Healthcare merger into a Treasury Bill due February 2023 and sold $95 puts in Alphabet (GOOGL) expiring in that month. This would have been my first foray into mega cap tech in many years. However, this trade was reversed in December when I made some trades to raise funds for a real estate investment. At that time, I also sold VICI Properties (VICI), JBSS, and a Capital One (COF) bond due 6/15/2023. This was done because of the attractiveness of the real estate and the desire to avoid a mortgage, not the fundamentals of these investments relative to other stocks and bonds. I currently expect to buy back two out of three positions in VICI, JBSS, or GOOGL once the sale of another property closes.

Lessons Learned

Patience remains the big lesson as in the first half of 2022. I could have waited longer on the NUO / NAD trade as well as adding to my PDO position. I income received from buying early was less than the cash I could have saved by buying later at a lower price. The Canadian government decision on Shaw at the end of the year also reinforces that I abandoned that trade too quickly. Maybe I am learning some patience however, as I continue to hold WBD and ATVI through these tough periods.

Outlook

I expect the Fed to do what they say and increase the Fed Funds rate another 0.75% to the 5.00%-5.25% range. Longer-term interest rates may have peaked as the end of the tightening cycle is now in view. The opportunity is still there for a few months to add to short and medium maturity fixed income investments. I expect the beaten up closed-end funds to recover in 2023 as well as cost of leverage goes down and NAV’s go up.

In stocks, I have a possibly unusual view that we may not see a recession in 2023, but stocks could still experience a significant decline before rebounding in the second half of the year. This is similar to the tech crash bear market of 2000-2002. The only official recession was from March to November of 2001, but stocks continued to drop until October 2002. The economy was recovering, but market sentiment remained poor into 2002, dragging down all sectors, not just the tech sector, which had already lost a lot. As I stated above, the decent 2022 performance of Industrials and Financials, as well as the relative outperformance of high yield bonds suggest to me that the recession is already over, not on the way. Nevertheless, it will take time for the market to notice that rates are done going up and earnings are not coming down as much as expected. Long term investors should not worry as we will be through this period soon. Traders and those with new cash to invest should consider weighting new investments more toward the middle of the year.

Appendix

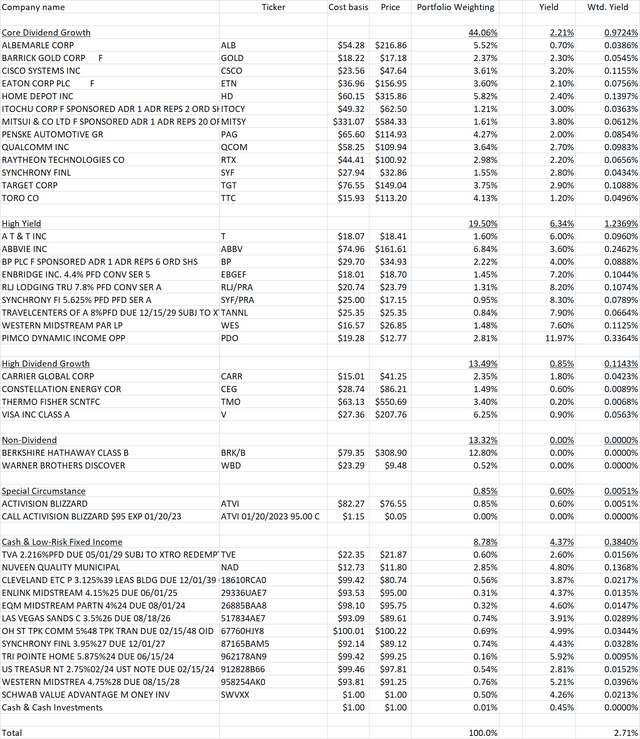

A full list of my holdings as of 12/31/2022 is below:

Author Spreadsheet

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.