Brief for “you want a finances,” YNAB is a budgeting app that makes use of the zero-based budgeting system that will help you make a plan for each greenback of your month-to-month revenue. The budgeting course of is concerned, however YNAB’s web site affords articles and movies to assist customers get with this system.

YNAB is a well-liked app with hundreds of opinions and excessive consumer scores (4.8 on the App Retailer and 4.7 on Google Play). The r/ynab subreddit has 193,000 members. We downloaded and examined the iOS app and used the web-based model of YNAB to learn the way it really works and who may gain advantage from it.

What’s YNAB?

Greater than an app, YNAB is a hands-on cash administration methodology based mostly on the next 4 guidelines:

-

Give each greenback a job. That is zero-based budgeting in a nutshell. You make a plan for a way you’re going to make use of every greenback of your revenue. An old-school method to do that is to put money in envelopes marked for particular bills.

-

Embrace your true bills. The thought is to take bigger, much less frequent bills (like an upcoming trip) and break them into smaller chunks so you’ll be able to finances for them every month.

-

Roll with the punches. This rule encourages flexibility; should you’re struggling to pay a invoice one month, you’ll be able to search for different areas to tug again.

-

Age your cash. This rule emphasizes watching your spending so you’ll be able to construct financial savings and enhance the time between while you earn cash and while you spend it.

It’s onerous to argue with the philosophy. These are sound guidelines that promote higher monetary habits.

Earlier than you construct a finances

NerdWallet breaks down your spending and reveals you methods to avoid wasting.

How a lot does YNAB price?

YNAB is a paid budgeting app with no free model, though new customers can begin with a free trial for 34 days. After that, it prices $14.99 per 30 days or $109 per 12 months. School college students get YNAB free for a 12 months.

YNAB could also be price the fee if it helps you spend much less and save extra money over time.

How does YNAB work?

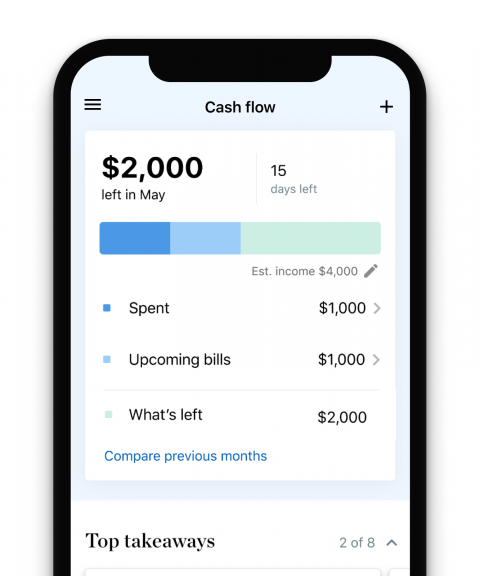

YNAB just isn’t a set-it-and-forget-it budgeting app. Relatively, it encourages you to play an lively position in managing your cash by defining budgeting classes, allocating cash to these classes after which intently monitoring transactions as they happen.

Outline expense classes

Preliminary setup is probably the most tedious half, however YNAB asks a couple of questions up entrance — about debt and what you prefer to spend cash on — that will help you outline spending classes. Consider these spending classes as line objects in a budgeting spreadsheet (like lease, groceries and meals out), however with a fancier design.

It’s essential to incorporate each spending class you’ll be able to consider in your YNAB finances, and chances are you’ll must seek the advice of invoice receipts, bank card transactions and financial institution statements at first. Don’t overlook so as to add classes for debt funds, saving and investing if relevant.

🤓Nerdy Tip

Do your self a favor and use YNAB’s desktop website on a laptop computer to arrange your finances. The bigger format makes it simple to be thorough when defining and organizing spending classes.

Full the setup course of by setting spending targets for recurring bills — like a month-to-month lease fee that continues to be comparatively fixed at $1,500 per 30 days — and add your present financial institution stability. You’ll be able to join your financial institution or add the stability manually.

Fund bills (solely with cash you’ve got)

YNAB needs you to be intentional and sincere with your self about your cash, which suggests solely assigning cash it’s important to your budgeting classes. Your financial institution stability shows on the high of the app and goes down as you allocate funds to every expense class.

YNAB doesn’t limit you from funding classes with cash not but there (for instance, the second paycheck you already know is coming later within the month), however you’ll see a unfavorable stability in brilliant purple that reveals you’ve assigned greater than you’ve got. Right here’s how one consumer put it on a r/YNAB Reddit thread:

“Think about you’ve got precise money and also you’re attempting to place it in envelopes. The purple bubble is there since you’re attempting to place money you don’t have but within the envelopes,” wrote u/HLef in response to a query from a YNAB beginner who was seeing purple.

File and categorize transactions

Funding your expense classes is the planning a part of YNAB. Recording transactions is the way you monitor precise spending. The hands-on nature of YNAB means you’ll must document and categorize transactions for a real-time take a look at how precise spending aligns with how a lot you’ve allotted to every class. You’ll be able to manually enter each buy your self, or hyperlink supported financial institution and bank card accounts inside the app to make importing transactions extra computerized.

YNAB is prone to work finest while you’re devoted about funding classes and recording transactions within the app.

What are the professionals and cons of YNAB?

The large good thing about YNAB — its tremendous hands-on method that encourages saving — could also be a downside that retains others away. Additionally, it prices cash.

Execs

-

YNAB is a sound cash administration philosophy inside an app.

-

The app is well-designed and likewise accessible on desktop.

-

There are many assets obtainable that will help you study the YNAB method.

Cons

-

This cash administration methodology is absolutely concerned, which can make it onerous to keep it up.

-

It’s dear and there’s no free model; at $14.99 per 30 days, you’ll spend practically $900 in 5 years (or $545 at $109 per 12 months).

What are some YNAB alternate options?

Budgeting apps are all the fad, and there’s no scarcity of choices to select from in 2024.

EveryDollar is an app (like YNAB) that makes our finest finances apps listing and affords a zero-based budgeting framework. Some customers might discover it less complicated to handle than YNAB. EveryDollar has a free and paid model.

PocketGuard is an alternate that’s huge on simplifying the budgeting course of. Basically, you’ll be able to hyperlink your financial institution accounts, bank cards, loans and investments, plus use the app to trace web price and monitor spending. PocketGuard additionally has a free and paid model.

Who’s YNAB for?

YNAB could also be for you should you’re severe about optimizing your funds and have the self-discipline to keep it up. To be efficient and get your cash’s price, you’ll have to be within the app adjusting your classes, forecasting the place your funds will go and recording transactions regularly. If you are able to do that, you’ll in all probability be higher with cash for it.

Methodology

We selected to assessment this app due to its reputation and excessive scores in each main app shops. We signed up for the free trial and performed hands-on testing utilizing each the desktop and cell app variations of YNAB to know the budgeting course of and discover key options.

Earlier than you construct a finances

NerdWallet breaks down your spending and reveals you methods to avoid wasting.