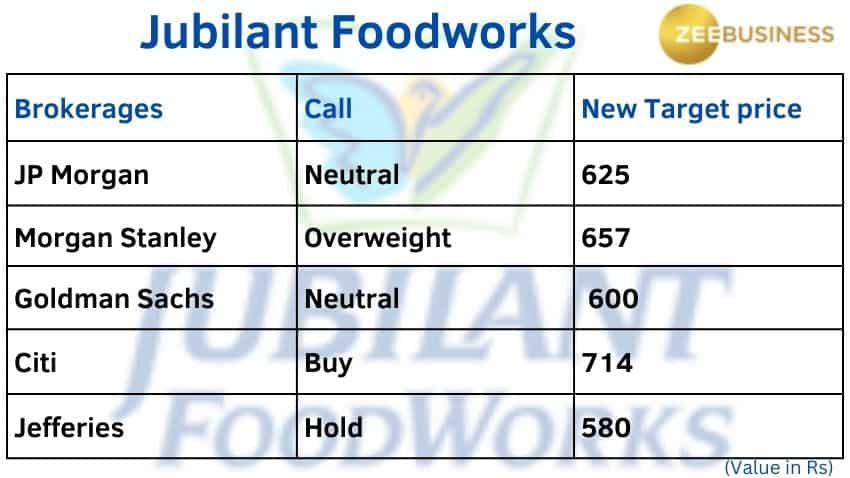

Jubilant Foodworks shares fell sharply on Wednesday after several brokerages cut targets on the counter despite an in-line September quarter results posted by the company on Tuesday. Top brokerages including Citi, Goldman Sachs and JP Morgan have revised their targets downwards.

The scrip was trading at Rs 578.30 on the NSE and was down by Rs 34.40 or 5.61 per cent apiece.

Source: NSE

While Citi has maintained a buy on Jubilant Food, it has cut the target to Rs 714 from Rs 725. Goldman Sachs has maintained a ‘Neutral’ rating but cut the target to Rs 600 from 630. JP Morgan too has maintained ‘Neutral’ rating on with a fresh target of Rs 623, down by Rs 5 from its previous target. The stock was recommended by these brokerages when it was trading around Rs 613.

The revision is on the back of contraction in its margins. The company which operates quick service restaurant brand Domino posted EBIDTA margin growth at 24 per cent in the July-September quarter which was down from 25.8 per cent Year-on-Year (YoY) it reported in Q2FY22. The margins were down sequentially too from 24.2 per cent in Q1 of FY23.

Gross Profit Margin stood at 76.2 per cent for the reporting quarter versus 76.7 per cent in Q1FY23 and 78.3% YoY.

The company reported a net profit of Rs 132 crore against Rs 120 crore in Q2FY22 which was up 9.4 per cent YoY. Net sales were reported at Rs 1301 crore versus Rs 1116 crore in July-September quarter in FY22, up 16.6 per cent YoY.

Brokerage firm Morgan Stanley is overweight on this counter has put a price target of Rs 657.

Jefferies maintains a Hold with a price target of Rs 580.

Also Read: Stock Market LIVE: Sensex, Nifty open strongly, Bank Nifty at all time high; Coal India top gainer

Technical View

Market expert Simi Bhaumik recommends a Sell in Jubilant Food estimating a further fall over the next 1-2 trading session. She said that the stock has seen a breakdown from level of Rs 590. She has given three targets at Rs 570, Rs 557 and Rs 545 with a stop loss of Rs 600.

Echoing similar sentiments, expert Ambarish Baliga suggested an exit in this stock. He sees a further 12% downside.

(Disclaimer: The views/suggestions/advises expressed here in this article is solely by investment experts. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)