jetcityimage/iStock Editorial through Getty Pictures

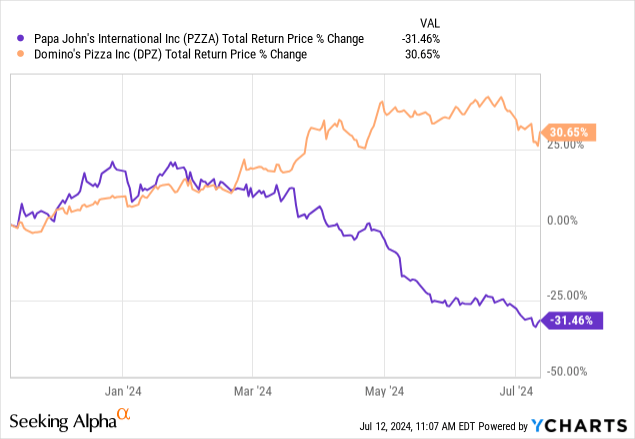

Papa John’s Worldwide, Inc. (NASDAQ:PZZA) stockholders have not had it simple in latest instances. These shares have now misplaced round 65% of their worth from their 2021 peak, having fallen round 30% (with dividends) since I opened on the agency final November. Overlaying it again then with a ‘Maintain’ ranking, I wasn’t thrilled with the valuation right here in comparison with what was on supply at shut peer Domino’s (DPZ), and with the latter outperforming by round 60ppt in that point, the distinction in fortunes between the 2 has been fairly stark.

Given the magnitude of the share worth decline, it could be pure to suppose that one thing has gone badly fallacious at Papa John’s. I am undecided it has. Granted, operations are in one thing of a mushy patch, with comps trying weak, earnings steerage downgraded, and web unit progress additionally trailing administration’s medium-term goal.

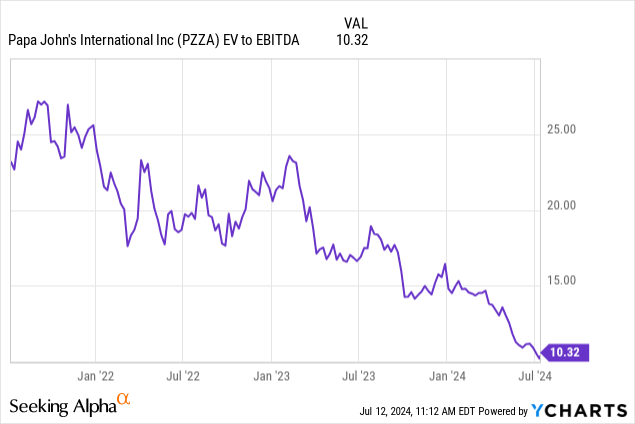

On that facet, I feel PZZA’s beforehand lofty valuation has been the bigger difficulty right here. The actual fact is that these shares had been on a punchy EV/EBITDA of over 20x at their 2021 peak, and that was all the time going to require a prolonged spell of robust progress to justify.

With the inventory down closely in that point, that EV/EBITDA a number of has contracted to across the 10x mark, which means buyers solely want very modest progress assumptions to make issues work. Whereas I’m conscious that the enterprise is not precisely firing on all cylinders proper now, there’s additionally a reasonably huge margin of security to work with right here, and I improve my earlier ‘Maintain’ ranking to ‘Purchase’ in consequence.

Hitting A Tender Patch

Papa John’s has launched two quarters’ value of contemporary figures since my preliminary piece (N.B. Q2 2024 outcomes aren’t due till subsequent month), and enterprise has undoubtedly weakened in that point. Comparable gross sales progress has turned damaging for one, with administration mainly pinning the blame on cost-conscious shoppers. North American eating places – which account for round 60% of the overall property measurement – noticed comps fall 1.8% year-on-year in Q1, whereas worldwide eating places fared barely worse, with comps down 2.6% within the quarter. This led to company-wide comps falling by round 2% year-on-year in Q1.

PZZA has continued to develop its retailer depend, so the impact on complete systemwide gross sales (i.e., the sum of all restaurant-level gross sales in each company-operated and franchised shops) has been extra modest, with this down slightly below 1% year-on-year in Q1 to $1.23 billion.

Steering has additionally been lowered. Preliminary steerage had Papa John’s delivering North American comparable gross sales progress of round 2% in 2024, representing the low finish of administration’s 2-4% long-term goal. Given the weak Q1 print, full-year home comps steerage has been downgraded to “flat to down low single-digits”. This has had a knock-on impression on working revenue steerage, with administration now seeing full-year EBIT at $150 million on the mid-point in comparison with the preliminary 2024 midpoint steerage of $158 million.

It is Not All Unhealthy

Whereas damaging revisions aren’t good, I’d level out that it is not all dangerous right here. Restaurant-level economics have proven enchancment for one, with home company-owned shops seeing round 220bps of margin enchancment in Q1 as inflationary pressures have eased.

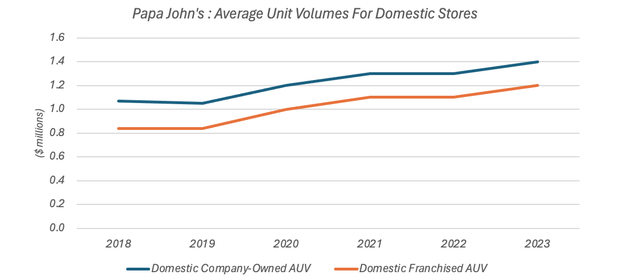

These company-owned shops delivered a circa 21% EBITDA margin in Q1. Franchised-store margins might be decrease, as royalty charges to the top firm swallow round 5% of franchised-store gross sales. Moreover, common unit volumes in franchised shops are sometimes decrease (they had been round $1.2 million final yr versus $1.4 million for home company-operated ones), so franchised-store margins are prone to be structurally decrease because of the inherent fastened value leverage in working a restaurant.

Information Supply: Papa John’s Worldwide Varieties 10-Ok

Having mentioned that, unit economics could be stable even when we had been to conservatively assume 10% EBITDA margins for franchised shops. As I discussed final time, a brand new retailer solely required money funding prices of round $345,000 again in 2018 as per that yr’s 10-Ok. With inflation, that has probably risen to round $450,000 at this time, pointing to a circa 25% return on funding given the implied franchised-store EBITDA of $120k. Franchisees are incentivized to open up extra shops if underlying returns on funding are enticing, in order that determine would give me some confidence with respect to future unit progress potential.

With that, administration’s longer-term goal is 5-7% annual web unit depend progress. Progress is trailing that presently, with the corporate reporting round 3.3% year-on-year web unit progress in Q1, however I’d be inclined to simply accept that that is largely on account of cyclical weak point on account of present macro circumstances. The secret is that unit economics nonetheless look stable right here – and that ought to in the end be a major driver of future earnings progress.

Valuation

The excellent news for potential buyers is that you do not want aggressive assumptions to make issues work right here. Helpfully, administration has additionally disclosed 2024 steerage on D&A (~$72.5 million), CapEx (~$80 million), and the efficient tax fee (23-26%) alongside the previously-mentioned determine for EBIT (~$150 million). These numbers get me to round $105 million in estimated 2024 free money circulation to the agency (“FCFF”). With PZZA’s present enterprise worth at ~$2.2 billion and its WACC at circa 7.8%, buyers solely actually require round 3% annualized long-term progress to make the present share worth work.

That may be a very low bar to clear. Franchised shops are extremely excessive margin and capital-light as they appeal to little by the use of extra working bills and CapEx. As well as, I discussed final day out that administration additionally plans to extend the margin on its home commissary enterprise from 4% (in 2023) to eight% by 2027. Excluding unallocated company bills, this enterprise accounted for round 18% of company-wide EBIT final yr. Administration plans to stagger this improve in annual increments of 100bps, and this could equally present revenue progress at little to no further improve in investments or bills.

As such, I count on Papa John’s to show significant leverage over working bills and CapEx, and this could gasoline robust progress in medium-term free money circulation. Certainly, present sell-side consensus implies round $128 million in FCFF by 2026, with implied FCFF margins increasing by round 20% to six% of gross sales. Incorporating that right into a easy DCF mannequin would get me to a good worth of roughly $65 per share, with that primarily based on a five-year forecast interval and a terminal ROIC-driven EV/EBITDA of round 12x. With the inventory presently at $43.56, there’s a fairly giant margin of security on supply ought to the corporate fall quick on the enterprise degree.

Summing It Up

This has been a tough few years for Papa John’s shareholders, with an funding on the 2021 peak in the end shedding round 65% of its worth with dividends included. Whereas enterprise is unquestionably mushy proper now, I do suppose the inventory’s beforehand wealthy valuation has been the larger driver of underperformance right here, whereas sound unit economics imply that the components for cheap future progress are nonetheless current. Most significantly, with these shares now buying and selling for simply 10x the estimated 2024 EBITDA, potential buyers have fairly a little bit of leeway ought to the agency in the end fall quick on the expansion entrance.